A Look Down the Passageway: New Room Coming Into Focus

All who have followed my writings over the last two years recognize the “Passageway” theme. It is a thematic, strategic view of major economic and social changes that seem to be occurring and in front of us due to various factors, including the shift away from economic globalization toward more nationalistic biases, electric vehicle/artificial intelligence (EV/AI) capital demands, the continued aging of the population base and building global nationalistic pressures. The Passageway theme centers on the period of transition from the old economic environment or “room” to the new environment.

My Passageways theme hasn’t been focused on the business cycle but rather on longer-term, secular changes that appear to be at hand. Over my 45-year career, I have witnessed three previous secular environments when gross domestic product growth and inflationary pressures shifted in magnitude greater than had previously been the case. The periods ending in 1981, 1999 and 2009 fostered points where major macro changes were at hand. It appears to me that we may be at the start of a new secular environment where sustained average inflation and economic growth rates establish a new trend.

Why the World Is Leaving the Old Room

For the last 18 months, I have been working on the Passageways theme, which outlines my view that the economic environment we are entering (New Room) will carry different earmarks than the economic environment that we have been leaving (Old Room). Between these two rooms lies the Passageway, which includes features from the Old Room as we get more glimpses of features in the New Room.

The fundamental driver behind these two rooms is the fact that a primary stimulus of activity in the Old Room was the seemingly never-ending process of the globalization of the world’s economy. David Ricardo’s “Comparative Advantage” was in full sail during the last 50 years when globalization—as measured by country-to-country trade activity—grew from around 24% of global GDP in 1970 to 63% in 20221. Due to this massive shift in how the world’s economy works, more than 1 billion people were lifted out of “deep poverty,” the majority of whom were Chinese citizens2.

This benefit came at a cost. China became the world’s factory floor. U.S. manufacturing represented less than 10% of GDP in 2021 as compared to 21% of GDP in 19703. In 2021 manufacturing represented 17% of global GDP.4 With this major shift, employment in manufacturing declined rather dramatically, from 22% of all jobs in 1979 to 9% in 2019.5 These jobs tended to be good-paying jobs. Then the COVID pandemic occurred.

Pandemic and Invasion of Ukraine Heighten Risks

The pandemic, a global human disaster, opened the world’s eyes to the supply chain risks that had been building up over the previous 20 years. The world had become dependent on one main supply source for many products—that being China, of course. Some called the pandemic the “China Flu,” a phrase that became politically incorrect. But while politically incorrect, like all popular phrases, truth resides in them to one degree or another.

Next, the world woke up to a much more aggressive political/military force in Russia as Ukraine contemplated joining NATO. This development occurred separate from the COVID issue. I suspect Ukraine’s desire to enter NATO simply served as an excuse for President Putin to take action and invade the previous territory of the USSR. The question of whether Putin had become a Russian dictator who wished to reassemble the former USSR appeared to be settled.

As far as supply chains go, Russia was the main supplier of petroleum products—particularly natural gas—to much of Europe. The 2011 Fukushima nuclear facility meltdown in Japan quickly led to the shuttering of a significant portion Europe’s nuclear-based electricity-generation capacity (save France). Europe turned toward natural gas as their preferred fuel for electricity generation. Russia’s invasion of Ukraine and Europe’s siding against Russian aggression served as the excuse for Russia to cut natural gas supplies to Europe. Another supply chain was broken.

New Room Comes Into View

These two events—the pandemic and the Russian invasion—had two main issues in common. Both China and Russia are command economies, ruled by dictators whose communistic political leanings are not viewed favorably by most in the West. The “siding” by major nations’ political/economic and military institutions were placed in focus. Secondly, both events served notice to the world that, due to an over-reliance on a single supply source for manufacturing products, the world needed to rethink and adopt a multichannel supply-sourcing discipline.

Consequently, the COVID lockdown and the Russian invasion of Ukraine showed the world that existing supply chain vulnerability was at hand. The days of unfettered globalization growth emphasizing sole-supplier status were numbered. The days of the world’s focus on disinflationary pressure and low interest rates were about to change.

I suggest the world’s economy has been traveling through the Passageway toward the New Room since the end of the COVID pandemic in 2023. The world has been traveling in the Passageway for the better part of three years. We have seen enough developments in the global economy and government and central bank reactions to such to come to a reasonable assessment of changes in expectations.

Shift to New Room a Process

Entering a New Room has never been an “event.” It is a process. The world’s economy has been undergoing this process for more than three years. The Passageway is a period where a number of the Old Room drivers are still present but are slowly fading and the New Room drivers are coming into focus. I have been suggesting that economic globalization drivers are no longer the driver behind price inflation (both consumer and market), economic growth and social structures.

Furthermore, I suggest the world’s economy has been traveling through the Passageway long enough for us to start to see some details of the New Room where our economy is heading. I have written in detail about a number of these factors. In summary, the details appear to be:

- A change in the globalization of the world’s economy. The pandemic taught the world that relying too heavily on one foreign-based supply source for too many goods is dangerous to companies and the macroeconomy in general. Call it reshoring, onshoring, friend-shoring. It all means more production is coming home to the U.S. and Europe from China. Bottom line, in the developed world, this probably means the cost of production of many goods will rise. This process raises both inflation and country-specific macro growth.

- The “green initiative” is real and has legs. The path toward low emissions is quicker under a liberal administration in Washington, slower with conservative leadership. The initiative will lead to higher levels of needed electricity production. The electric vehicle revolution will/is broadly raising costs and will push inflation upward and slow overall macro growth as financial resources are dedicated to this area without any real, positive growth. And the push by the developed world will not solve the world’s carbon emission problem. Much of this may prove to be a “mis-investment” process. For some time, capital will be needed to fund green initiatives. As the issue may increase competitive demands for capital, it may be additive to higher longer-term interest rates.

- The world is forming into two major political/economic camps. Let’s call them the “democracy” camp and the “totalitarian” camp. Known players in the totalitarian camp are China, North Korea, Venezuela, Iran, Cuba and Vietnam. Most other countries reside in the democracy camp. Those of us old enough to remember life under the Cold War cloud understand this world. Two probable outcomes of this global socioeconomic division are changing trade alliances and higher levels of defense spending. Neither of these creates sustainable economic growth or lower inflation. The global division creates economic drag, and spending on military weapons systems takes money away from other societal needs, raising demands for capital, interest rates and inflationary pressures.

- AI, while in its infancy, should increase the need for higher levels of electricity creation. Initially, the buildout and adoption of AI should increase national production costs. But eventually (assuming various outcomes), worker productivity growth rates should benefit from AI adoption. Over the shorter term, AI may prove to harm inflation outcomes. But longer term, it should help reduce overall inflationary pressure, as the hope is AI will positively affect worker productivity levels, eventually bringing a new wave of collective, societal wealth creation to the fore.

- The aging of the developed world population base will naturally continue. This means worker productivity growth should rely more heavily on innovation and technology advances than on population/work force growth. It also means pressure on government spending to care for an ever-aging population base won’t go away. This factor diminishes growth rates and adds to inflationary pressures. To flesh this out, currently 77% of the world’s population resides in either Asia or Africa, with 15.7% of the global population residing in the developed world (North America, Europe and Japan), according to the United Nations. The UN forecast suggests that by the year 2100, Asian/African areas will contain 84% of the world’s population, and the current developed world will represent 10.6% of the world’s people. Economic growth will be challenged in the developed world, as this area’s share of the global workforce will shrink.

While not all-inclusive, the five outcomes noted above seem to now be in view as we come closer to entering the New Room. Capitalists, take note: The supply chain reshoring, the green initiative, the buildout of the electric grid are all capital-intensive efforts. Capital will be in great demand by many going forward.

And finally, the New Room suggests that …

- Government will be bigger. In the past, I have written on a number of the factors noted above. Today I want to bring forward government’s role in the New Room. If the pressures in the New Room play out as I suspect, we may see an ever-more-intrusive government presence in our lives. This will prove to be anti-growth and pro-inflation. Why is this the case?

First, as a building block, I suggest the voting public in the U.S. has become more liberal than has been the case over the last 40+ years. This is primarily due to the changing demographic mix in the U.S.

Millennials and younger generations have now come of age. They now outnumber the baby boomers, as the oldest of the boomer generation are now 78 years old and starting to pass away. They are being replaced by millennials and younger generations, who are much more likely to think, act and vote more liberally than their parents.

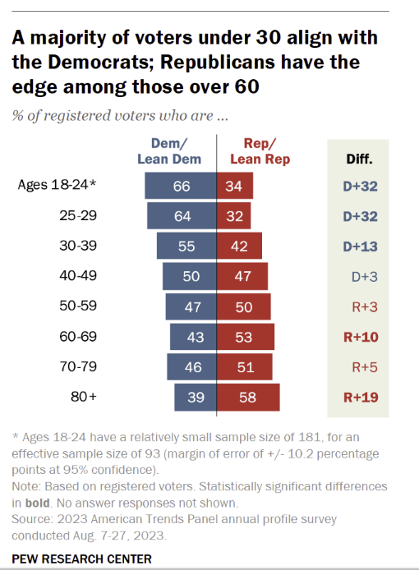

Data backs this view. Note the chart here, supplied by the Pew Research Center, which shows that 63% of 18- to 39-year-olds identify as Democrats, while 36% of this group call themselves Republicans. Compare that to the boomers at 54% Republican and 42% Democrat. Note the difference column to the right of the chart, which shows a definite age bias in voting preferences. Frankly, many in the older population base view government as the problem and not the solution to problems, while younger voters tend to not trust market-based solutions as much as their parents.

Rising government spending as a percent of GDP (now approaching 25% of GDP as compared to historical norms at 17%-19%6), together with the fact that taxes received (again, as a percent of GDP) have remained rather steady over the long run, explains why government deficit spending is so high and why demands placed on the capital system are worrisome.

I suggest higher systemic government spending as a percent of GDP leads to lower overall secular growth and higher inflation pressures, to say nothing of the pressures these issues place on interest rates.

The New Room: Higher Inflation, Lower Growth Rates?

In summary, it appears to me that inflation will probably be systemically higher in the New Room than was the case in the Old Room. Also, macro “real” growth rates should be lower than historical norms would suggest.

Of course, the final word on the New Room issue has yet to be written. These are all speculative statements and views, which will need to be altered to one degree or another as reality takes the place of speculation. That said, it seems the world is changing (as it always does), moving away from globalization toward something different.

The purpose of this work, which has been incubating for more than a year, is to allow the reader to think about things on the horizon, far away from current focus. By focusing on these issues, perhaps we can gain an insight into major drivers of capital allocation importance. I certainly don’t have the answers, and perhaps some of the views in this work will, over time, prove to be false. But thinking about these big picture items is worthwhile for all investors.

1Macrotrends

2World Bank

3-5Statistica

6Yardeni Research

This commentary is provided for informational and educational purposes only. As such, the information contained herein is not intended and should not be construed as individualized advice or recommendation of any kind.

The opinions and forward-looking statements expressed herein are not guarantees of any future performance and actual results or developments may differ materially from those projected. The information provided herein is believed to be reliable, but we do not guarantee accuracy, timeliness, or completeness. It is provided “as is” without any express or implied warranties.

There is no assurance that any investment, plan, or strategy will be successful. Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results, and nothing herein should be interpreted as an indication of future performance. Please consult your financial professional before making any investment or financial decisions.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.