CARES Act: What Does It Mean For You?

The full impact of the COVID-19 (coronavirus) Pandemic will not likely be known for many years. With new phrases in our daily conversations, such as shelter-at-home, social distancing and concluding every communication with “stay safe and healthy,” we’re experiencing impacts to our lifestyle in ways we never would have imagined.

Not only has our lifestyle been disrupted, but also our financial and economic stability. With layoffs and businesses closed due to quarantine requirements, much help is needed to get everyone back on their feet. The Coronavirus Aid, Relief and Economic Security Act (CARES Act) was designed to provide that much needed help.

The CARES Act stimulus package was signed into law on March 27, 2020. Through nearly unanimous support, the stimulus package is the largest ever enacted, with the total cost estimated at over $2 Trillion.1

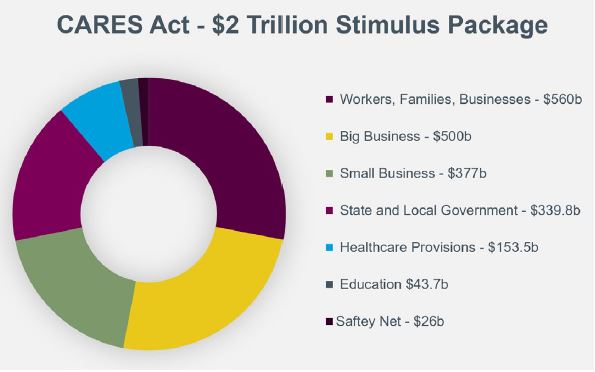

Overall, this economic stimulus is broken up into these key categories:

Workers, Families and Businesses – $560 billion

Recovery Rebate

The most significant impact to families is the loss of income due to the shelter-in-place mandate. Unless you’re working for an essential business or have the ability to work remotely, you’ve likely found yourself furloughed with little or no pay. The most significantly impacted are individuals working in the travel, hotel, restaurant, retail and entertainment industries. Therefore, the largest provision of the bill includes potential support to the most affected individuals.

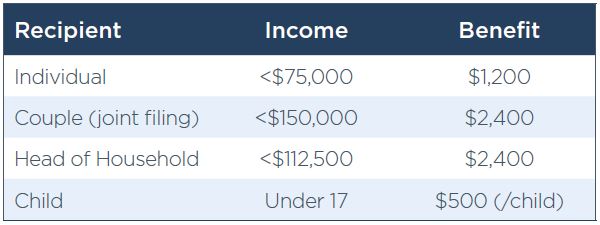

The bill provides Recovery Rebates in the following way:

The Recovery Rebate begins to phase out when income exceeds these thresholds at the rate of $5 for each $100 above.

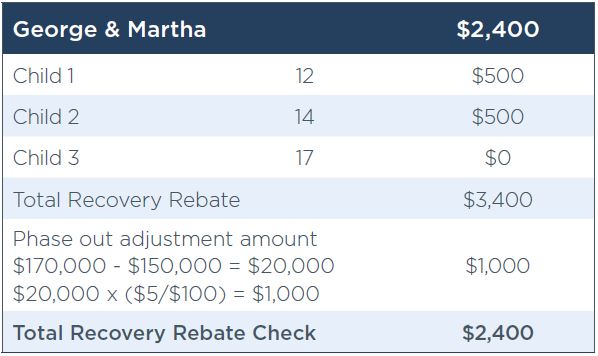

For example – George and Martha have a household income of $170,000 and have three children ages 12, 14 and 17. We’ll first calculate the potential Recovery Rebate and then adjust it for their income.

RMD Waived For 2020

With the impact to retirement portfolios, the Required Minimum Distributions (RMDs) for 2020 have been waived. The rationale is based upon the fact that Dec. 31, 2019 asset values will likely be much higher than those throughout the year; therefore, they will not be required this calendar year. RMDs will continue with their regular payment schedule in 2021.

Please note that if you’ve already completed your 2020 RMD, work with your wealth advisor to determine what options may be available.

Access to Retirement Funds1

Withdrawals from Qualified Retirement Plans

During times of hardship, many individuals may be forced to consider accessing their qualified retirement plan such as a 401(k). Unfortunately this creates not only a taxable event but also includes a 10% penalty. Moreover, typically these funds cannot be returned to these plans when individuals are earning income again. The CARES Act now provides individuals the ability to access these plans more easily.

The new guidelines, in effect for distributions taken between Jan. 1, 2020 and Dec. 31, 2020, permit individuals to withdraw up to $100,000 without the 10% penalty. While the withdrawal is still taxable, the income can be spread over the next three years. Another provision also permits individuals to recontribute these dollars back into the qualified plan irrespective of the contribution limits.

When exercising this option, please consider these guidelines:

- Withdrawal must meet Coronavirus related criteria

- Have been diagnosed with COVID-19

- Caring for a spouse or dependent diagnosed with COVID-19

- Financially impacted by the stay-at-home mandates, such as being furloughed, reduced hours, being laid off or not working due to a loss of childcare

- Own a nonessential business and had to close

- Withdrawal must occur in 2020 (Jan. 1, 2020 – Dec. 31, 2020)

- Waives 10% withdrawal penalty

- Maximum withdrawal benefit of $100,000

- Withdrawals are taxed over three years

- Withdrawal amounts may be re-contributed back to account during this three-year period and will not be applied to contribution limits

Loans from Qualified Retirement Plans

As an alternative to withdrawing funds from your qualified retirement plan, it may be possible to borrow funds and repay them.

Beginning with how much of the plan assets can be used, prior to the stimulus package, the maximum loan amount individuals could borrow was 50% of their vested balance or $50,000, whichever was less. If their account balance was less than $10,000, individuals could borrow up to $10,000.The CARES Act amends this rule and allows an amount equal to the lesser of $100,000 or 100% of the employee’s vested account balance before it’s a taxable event. Any payments for these loans as of March 27, 2020 to Dec. 31, 2020, will be delayed for one year.

Please keep in mind that withdrawals and loans from your qualified plan should be evaluated very carefully; therefore, individuals should consider seeking assistance from their wealth advisor and tax professional.

Additional Unemployment Benefits2

A direct result of the shelter-in-place mandate for millions has been job elimination. As of March 26, 2020 3.28 million people had applied for unemployment. With the average unemployment check provided by states (pre-stimulus) being just under $400/week, there is no doubt that additional assistance is needed. The CARES Act provides a federal benefit of $600/week for up to four months in addition to the state-level benefit..

Additional benefits may also be available for loss of income by independent contractors, self-employed workers, and workers with a limited work history.

Individuals in these areas should reach out to their state’s unemployment office for details.

Charitable Deductions3

For charitable contributions made to qualifying charities in 2020, the act provides options for those who itemize and those who don’t. Beginning with those who itemize, the CARES Act permits a charitable deduction of up to 100% of their adjusted gross income. For individuals who do not itemize, a new “above-the-line” deduction of up to $300 is permitted.

To qualify for the deduction, the contribution must be made in cash in 2020, and it must go to a public charity or foundation as described in section 170(b) (1)(A). Contributions to a supporting organization or donor-advised fund don’t qualify.

For Small Business – $377 billion

Like individuals, small businesses (fewer than 500 employees) have been greatly impacted by the pandemic. To increase the likelihood of continuing their businesses, several new loan and tax provisions are included in the bill:

- Paycheck Protection Program – this program provides access to loans that would provide immediate cash to continue meeting payroll needs.

- Employee Retention Credit for employers subject to closure due to COVID-19

- Forgivable Loans – if eligible, businesses can obtain loans at 0% interest and can receive a credit to forgive the loan over time. This provides much needed capital to reopen many businesses.

- Payroll Tax Payment Deferrals

- Net Operation Loss rules are relaxed

- Emergency Grants – accessing cash immediately is likely the most important thing for businesses, and the new emergency grant programs provide assistance until other funding is in place.

- SBA Emergency Injury Disaster Loan (EIDL) program has been expanded

For additional details on provisions for small-business owners, COVID Stimulus Package: Notes for Business Owners.

Big Business – $500 billion1

Much like small businesses, large businesses have been tremendously impacted by COVID-19, and similar to stimulus that was implemented during the Great Recession, there are several provisions to support impacted businesses.

Beginning with the airlines, nearly $58 billion will be directed to help them stay open. A portion of that must be set aside for employee wages, salaries and benefits. It is further divided into funding for passenger, cargo and airline contractors.

For all other large corporations, loans and other money may be used to support their businesses. It must be paid back to the government, and they must disclose when they have received these funds.

Other restrictions and rules have been put into place to help ensure funding is provided to a qualified corporation. This includes:

- An oversight committee made up of members of Congress

- No business with ties to any government official will be permitted to request funds (this includes the president, vice president, members of the cabinet and Congress)

- No business may buy back their own company stock within a period of time that extends one year beyond the term of the loan

- All loans must be repaid and cannot be forgiven

State and Local Government Support – $339.8 billion1

These provisions are divided into two primary areas: $274 billion that will go toward COVID-19 response efforts and $150 billion in additional cash aid for those state and local governments experiencing a high number of cases.

There is additional aid for Community Development Block Grants, K-12 schools, higher education and $5.3 billion for programs for children and families, including immediate assistance to childcare centers.

Healthcare systems – $153.5 billion1

The bill includes much needed provisions to help support the overextended health care system. Specifically hospitals, community health centers, VA services and telehealth services that have been directly involved in screening, treatment and other support will receive additional funding.

To expedite the approval of new drugs along with adding support for new diagnostic testing, treatments and vaccines, additional funding will be provided to the FDA as well as increased funding for the Strategic National Supplies to increase availability of medicines, equipment such as respirators, ventilators, PPEs, etc. and the hiring of additional personnel.

Education – $43.7 billion5

The CARES Act has several provisions that will help student loan borrowers:

- For students with outstanding loans through Direct Loans and FFEL loans, a key provision is the ability to suspend payment until Sept. 30, 2020. Moreover, interest will not accrue during this suspension.

- For those students who are seeking student loan forgiveness through the Public Service Loan Forgiveness program, this suspension period will count toward the forgiveness.

- For students in an income-driven repayment plan, the suspended payments are also considered qualifying payments that can be counted toward forgiveness.

- Credit reporting services will reflect suspended payments as if they have been made.

- Employers may apply education assistance benefits directly toward an employee’s student loans (Maximum of $5,250).

Safety Net – $26.5 billion1

With school closures and the loss of millions of jobs, many families are experiencing food insecurity. To address this concern, the CARES Act provides additional funding for the following programs:

- Child Nutrition – available through k-12 schools

- Food Banks – to support food banks’ ability to acquire needed resources

- Food Stamps program – with the increase in unemployment, SNAP funding will be increased to support those in need.

Questions? Contact Your Advisor

Given the complexities of the new bill, you might consider reaching out to Mariner with any questions you may have. We’re here to help you navigate your financial future.

Primary Source: https://www.congress.gov/bill/116th-congress/senate-bill/3548

Secondary Sources:

3 https://taxfoundation.org/unemployment-compensation-changes-cares-act/

4 https://home.kpmg/content/dam/kpmg/us/pdf/2020/03/tnf-cares-act-mar27-2020.pdf

This article is limited to the dissemination of general information pertaining to Mariner Wealth Advisors’ investment advisory services and general economic market conditions. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on information and sources of information deemed to be reliable, but Mariner Wealth Advisors does not warrant the accuracy of the information that this opinion and forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.