Economic Outlook: Modeled Economic Impact of Trump Plans

Read time: 10 minutes

Happy New Year! Now that the presidential election is over, some are asking about our view of the potential economic impact of President-elect Trump’s plans. Our previously released outlook, entitled “Three Yards and a Cloud of Dust” that covered our core view of expected economic growth and inflationary pressures for 2025, remains and acts as our “core” view of 2025’s economic prospects. We had previously assigned a 60% probability to the “Three Yards” outlook. Its theme is one of a slow-growth, grinding positive economic environment unfolding in 2025, surrounded by noise and various risks. With Trump returning to the White House, the noise and various risks factors will probably be occurring over the next few years.

During the campaign and since, President-elect Trump has spoken on many issues. To analyze the economic impact these promises may have on the U.S. economy would be speculative, to say the least. But that said, I believe a simple effort of analyzing the potential changes Donald Trump may bring forward is worthwhile.

I suggest the economic impact of the main issues Trump has campaigned on can be broken into four “buckets.” These buckets are:

- Implement tax law changes

- Implement broader, higher tariffs on imports

- Lock down border with Mexico; start the deportation of undocumented immigrants

- Reduce government activities and regulatory burden on the private economy (DOGE)

Three Yards and a Cloud of Dust

Released prior to the election, our Three Clouds commentary suggested overall “real” economic growth should slow to 1.5% to 2.0% in 2025 from the 2.5% to 3.0% rate we experienced in 2024. We have also made the case that inflation should continue its slow, downward march to 2.2% to 2.5% in 2025 from the current 2.8%. Now that the election results are known, we can handicap our view given the variables noted above.

Changes With Trump Victory

What kind of changes may we expect to see as a result of Trump’s potential initiatives as we enter the new year? Let me say that the effects that the aforementioned four buckets may have on our economic environment depend on a couple of currently unknown factors. First, to what degree will all four of the bucket items actually occur? Secondly, understanding the degree of impact next year will, of course, depend not only on how and to whom the new prerogatives are applied but also on when the application of the new environment will take place. The fact that all four of these buckets will result in a new, higher degree of uncertainty on economic activity and confidence is unquestioned.

With those two broad disclaimers having been made, we now turn to our view of the potential impact from each of the buckets.

Tax Law Changes

Trump’s proposed tax law changes include the extension of the Tax Cuts and Jobs Act of 2017 (TCJA) provisions, reducing the business income tax rate to 15% of earnings on domestic production, the permanent expensing of capital investments (including R&D) and other features.

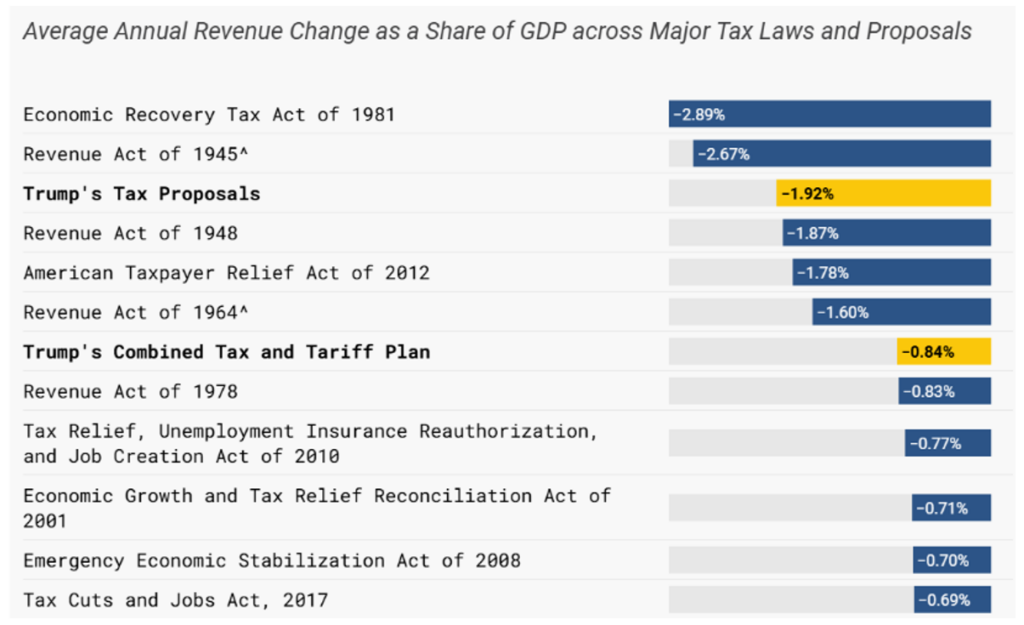

It is unquestioned that what President-elect Trump has outlined regarding his desired tax law changes during his new term will be historical in size and scope. Note the chart below from the folks at the Tax Foundation, which shows the size of historical tax reductions measured against the then-gross domestic product (GDP) rates of the overall economy. Trump’s tax plan, as outlined, will rank as the third-largest change in tax law to reduce taxes over the last 75 years, cutting taxes paid to the federal government by $300 million per year over the next 10 years.

The Tax Foundation’s economic modeling suggests that the impact of the new tax laws may reduce revenue to the government by 1.9% and increase overall economic growth by 2.4% over the longer term. I suggest the potential impact on inflation will be minimal, but the business provisions may spur businesses to accelerate capital spending plans, which may trigger an eventual higher level of worker productivity growth, a definite positive when it comes to the inflation reduction conversation. Standing on its own, the tax law changes may increase the government deficit by about $300 million per year.

It is important to note that these changes won’t take effect until both the House and Senate vote in favor of implementation. Consequently, the positive impact on GDP growth, and business investment spending, probably won’t occur until late in 2025 or in 2026 at the earliest.

Higher Tariff Rates on Imports

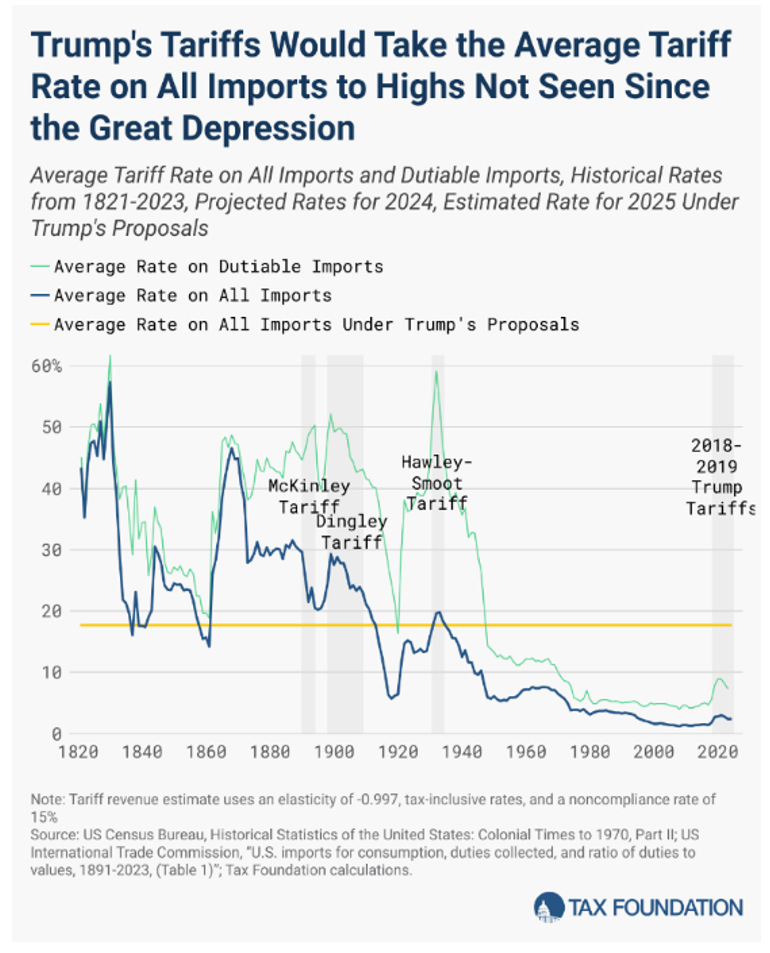

Major features of the proposed increase in tariff rates on imports include raising rates on imports from China to 60%, up from today’s 40% level, and increasing tariff rates on other imports to 20%. In total, tariff rates would rise to a rate we haven’t seen since the Great Depression (see chart below).

A strong argument can be made that the benefits to economic growth of the potential tax law changes will be mainly offset by the drag on economic growth that increased tariff rates may have on the economy. The Tax Foundation’s modeling process suggests that upwards of 65% of the GDP growth benefit fostered by lowering taxes would be lost due to higher tariff rates, as outlined by President-elect Trump. Its analysis includes probable retaliatory tariffs placed on U.S. exports.

Much of the tax revenue that is lost due to the outlined tax law changes would be replaced by revenue generated through higher tariff rates. The Tax Foundation suggests the government deficit would rise by $250 billion per year when considering probable impact of the tax package and increased tariffs combined.

See the chart here that shows the total tariff rates in the U.S. as a percent of import values (dark blue line). Note the yellow line that indicates what tariff rates would be if Trump’s plans are implemented as suggested. Rates would be the highest we have seen since 1940. Increasing tariffs would irritate inflation, driving prices higher.

The timing of the implementation of the tariff rates could be rather quick, particularly if “national security” is the stated reason for each country’s new tariff rate. This argument could be easily made when thinking of imports from China but would be more difficult when thinking of Canada and Mexico. So, the timing and impact on 2025’s economy would be real but muted in relation to the possible longer-term outcome.

Deportation of Undocumented Immigrants

The approximate number of undocumented immigrants in the U.S. is 14.4 million1. About 8.3 million of the 14.4 million are counted in the workforce (58% are working). Supposedly, the initial focus would be on the deportation of those with known criminal records. If all undocumented immigrants were deported, the impact on the workforce would be meaningful, particularly in certain labor-intensive industries.

An argument can be made that depending on the degree and timing of deportation actions, wage pressures would rise in labor-intensive industries (construction, domestic care, hospitality) and productivity would fall. These actions, while perhaps politically and socially necessary, carry few real macroeconomic benefits.

The timing of the economic impact will rely on how aggressively this process is applied. That said, we may not see the full economic impact of these actions until 2026.

Reduce Government Activities and Regulatory Burden on the Private Economy

The popular label for these efforts is DOGE (Department of Government Efficiency). Federal government spending has, since the pandemic, increased to 24% of total economic activity (nominal GDP) from 15% to 19% historically2.

Few would question the view that waste and inefficiencies run though all governmental layers. Some have been suggesting that the DOGE efforts need to be especially critical of government structure to the point of questioning the need for the existence of some government departments. Elon Musk (consultant in this arena) has suggested that DOGE’s efforts will yield upwards of $2 trillion in proposed spending cuts. Whatever the number turns out to be, we applaud these efforts, as government waste and bloated structure needs pruning. Depending on what is delivered, we suggest there are few downsides and multiple economic benefits to these efforts.

Net Effects on Growth and Inflation – Still Guesswork

So, what may we expect in relation to our Three Yards baseline macroeconomic outlook for 2025? What of beyond 2025?

The two highlighted efforts may have a greater impact on 2025 economic activity than the two other issues, as the timing of tariff changes and deportation of undocumented immigrants doesn’t rely solely on congressional approval. On balance, our view (depending on details and timing of implementation of those details) suggests downside pressure on GDP growth and upside pressure on inflation may be the net result in 2025. It needs to be emphasized that the major impact of these changes probably won’t be felt until 2026.

Last Word

This commentary is highly speculative. As such, we are staying with our Three Yards economic forecast in 2025 of slightly lower growth and inflation than witnessed in 2024. But the changes that President-elect Trump has outlined should have a meaningful impact on economic activity in 2026 and beyond. We will continue to follow the launch and developments of the new Trump initiatives.

Key Takeaways

- With new presidential leadership, we can count on significant new plans and programs in four key buckets to unfold over the next year.

- Each of these buckets has the power to substantially impact national economic growth and/or inflation rates. The timing and magnitude of each program is yet to be fully known.

- Due to the nature of these potential programs, it is difficult or impossible to handicap an accurate forecast at this time for national GDP growth and inflationary pressures in 2025.

- We stand by our “Three Yards and a Cloud of Dust” outlook of slightly slower overall GDP growth in 2025 versus 2024 combined with pressures that should help to slowly drive inflation downward. We assign a 60% probability to this outcome.

- As time and events unfold next year, we will be more able to assess the true impact of the new administration’s macro plan.

Sources:

1Associated Press

1Federal Reserve Bank of St. Louis

This commentary is provided for informational and educational purposes only. As such, the information contained herein is not intended and should not be construed as individualized advice or recommendation of any kind.

The opinions and forward-looking statements expressed herein are not guarantees of any future performance and actual results or developments may differ materially from those projected. The information provided herein is believed to be reliable, but we do not guarantee accuracy, timeliness, or completeness. It is provided “as is” without any express or implied warranties.

There is no assurance that any investment, plan, or strategy will be successful. Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results, and nothing herein should be interpreted as an indication of future performance. Please consult your financial professional before making any investment or financial decisions.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.