Economic Outlook: Update: Three Yards and a Cloud of Dust

Read time: 9 minutes

I delivered my core 2025 economic outlook late in 2024, suggesting that we would experience a slowdown in economic growth this year, but remain comfortably in the growth arena.

In 2024, I called for real Gross Domestic Product (GDP) growth of 2.0% to 2.5%. The advanced estimate for the full year 2024, published at the end of January 2025, showed that real GDP growth came in at 2.8%, slightly faster than my forecast. 1 I also called for inflation (core PCE) to decline slightly from 2023. As of the latest view, that indicator came in at 2.8% in December, down slightly from earlier in 2024, according to the St. Louis Federal Reserve, in line with expectations. 2

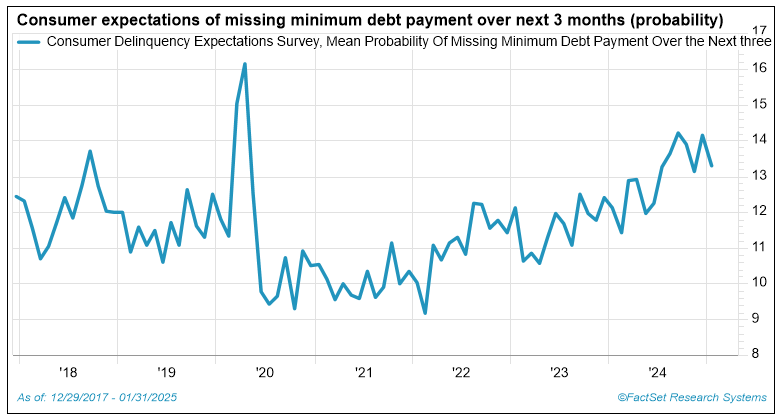

My core outlook for 2025 calls for further trend slowing in GDP growth to the 1.5% to 2% range. The main driver of the continued decline in growth rate is consumption activity, which is currently strained in the lower-income segment of the population. The chart below highlights the percentage of consumers who expect to miss a loan payment in the next three months. The wealthier consumer is still showing strong spending trends as personal balance sheet strength (rising stock and housing values) plays into their consumption patterns.

Source: FactSet

From a thematic perspective, my economic outlook for 2025 is Three Yards and a Cloud of Dust. I hope to create an image in your mind’s eye of a football play, a grind up the middle of the line, picking up short yardage and creating a “cloud of dust.” Progress is made, but a lot of noise and dust is created.

I expect to continue to notice the “cloud of dust” primarily coming from Washington D.C. with the new administration. So, I believe the Three Yards and a Cloud of Dust theme is appropriate.

Businesses Are Doing Well

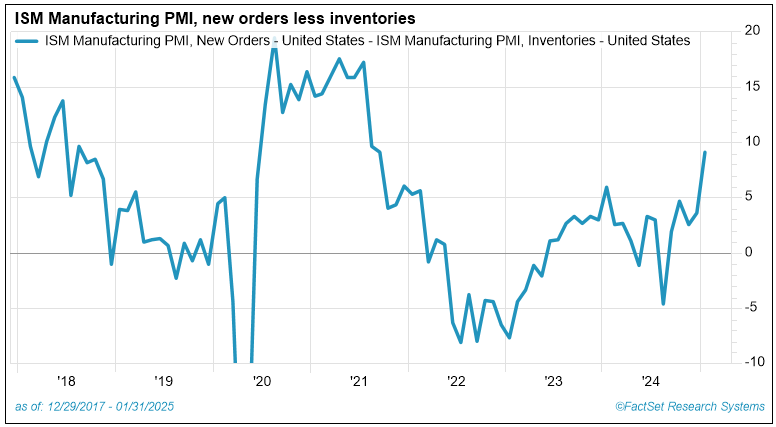

Recent data from ISM shows that business order rates are robust. Note the chart below, which shows a recent strong uptick in order rates relative to inventory rates. This suggests business revenue growth is healthy, over and above inventory build.

Source: ISM

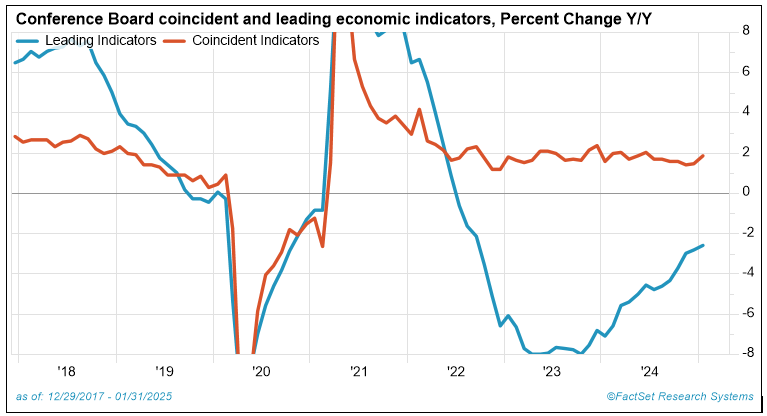

We can also see the data from the Conference Board below, which depicts both economic leading and coincident indicators. For quite some time, coincident business indicators were fine, but leading indicators had been weak. Early last year, the leading indicators started turning to the positive and have remained in that trend for a year. As both indicators are positive, it would be odd for business activity to quickly flip into a negative trend.

Source: FactSet

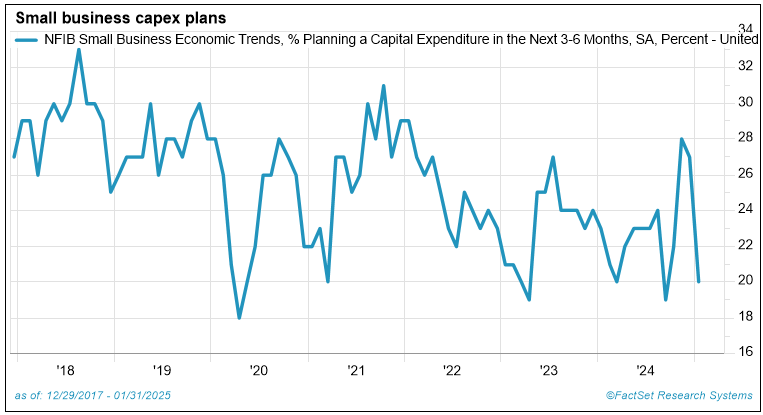

Lastly, we have a chart that shows small business capex plans, which have been weak for quite some time. That trend has reversed following the election in November of last year. So, the “three yards” of my economic outlook is aligned with a decent business environment.

Source: FactSet

Four Buckets Recap

I have highlighted and studied reports and economic models, which forecast what President Donald Trump’s major initiatives may do to economic growth and inflation pressure. I have written rather extensively on this subject. I have called Trump’s initiatives his Four Buckets: Tax Policy, De-immigration, Tariff levels and DOGE efforts.

Most economists have the view that two of the buckets would irritate higher inflation pressures and drag economic growth downward—de-immigration and tariff policies—while two of the buckets promised to lower inflationary pressures and raise potential economic growth—tax policies and DOGE efforts. We can argue the fine points of these programs, but most economists, including me, believe that is the starting point for most discussions on these issues.

Timing of the Buckets

I believe the macro effect of the buckets will partially be determined by the timing of the effective change brought by each bucket.

We have been exposed to whipsawing tariff change announcements. We started off with Trump telling us tariffs on China would be 60% and everyone else at 20%. Then the levels changed, and Canada and Mexico were singled out with high tariff rates, only to be eliminated with 48 hours of the announcement. As of Feb. 13, we were told that Trump leaned towards a “matching” tariff where tariff rates would be “reciprocal” with other countries. 3 If a particular country applies a 5% tariff to imports from the U.S., the U.S. will apply a 5% tariff to all imports from that specific country.

But the bottom line: we are dealing with a moving target. And we haven’t even gotten around to talking about the changing tax policy nor the true effect, or even a speculative guess as to what we will see from the DOGE efforts.

Therein lies the “cloud of dust” regarding Trump’s buckets. A lot of dust is being kicked up, clouding a clear economic picture. Why worry about the four buckets? Because each separately can change macroeconomic outcomes dramatically. Because we can’t bank on any specifics, the “cloud of dust” seems to have the power to delay economic decisions by businesses and consumers.

Michael Cembalest at J.P. Morgan has done a yeoman’s job on the legal and constitutional issues arising from Trump’s buckets. I paraphrase, but according to his work we can surmise:

Category A: Initiatives that are legal or most likely legal and don’t need to be addressed in Congress:

- Repealing Biden Executive Orders.

- Imposing increased duties on imports, though Trump’s use of the International Emergency Economic Powers Act in the context will likely be scrutinized.

- Terminating federal employees who currently are not subject to federal civil service protections.

- Restructuring or eliminating agencies that were not created by federal statues and whose independent existence is not otherwise statutorily required.

- Abolishing DEI offices, training and programs in federal agencies.

- Aggressively deporting undocumented aliens pursuant to standard statutory procedures.

- Pausing implementation of government programs, such as renewable energy subsidies.

Category B: Initiatives more susceptible to substantive judicial challenges.

- Directing federal agencies to refuse to recognize birthright citizenship for U.S. born children of undocumented immigrants.

- Refusing to spend appropriated funds or redirecting them to other unauthorized purposes.

- Unilaterally removing commissioners of independent agencies.

- Eliminating Federal agencies that have been created by statute, such as Department of Education and Federal Emergency Management Agency.

- Economically coercive terms and conditions for cities to qualify for certain Federal, funds—addresses the “sanctuary city” issue.

- Abolishing USAID.

Category C: Constitutionality and other legal issues related to DOGE:

- The order creating DOGE states it is purely advisory. Presidents have often turned to the private sector for advice.

- Elon Musk has been designated a “special government employee.” He is permitted to provide “temporary duties either on a fulltime or intermittent basis.”

- Trump’s latest executive order instructs agency heads to prepare for large scale reductions in force, and to prioritize laying off people who perform functions that are not statutorily required.

- The administration’s buyout offers to Federal employees raises legal questions.

Summary

Trump’s plans—initiating emergency actions and forcing “sanctuary cities” into federal compliance—to deport massive amounts of illegal immigrants could and probably will be challenged in court. So, the unbound ability to deport people en masse will probably be hampered but will proceed at a lesser pace than some have been expecting.

The tax policy changes probably won’t affect 2025 tax rates as changes in tax laws have to be approved by Congress. The 2017 Tax Cuts and Jobs Act (TCJIA) doesn’t expire until the end of 2025. Many believe Trump’s proposed tax changes won’t take effect until 2026. If that is probable, the possibility that tax rates will come down this year, helping drive higher GDP in 2025, won’t happen.

DOGE is running into political flak at every turn. Elon Musk and his team can only “advise” the Trump on changes they believe need to be made. If spending in one area or the other isn’t protected by mandatory statute, then that spending may be a fair game for change. So, DOGE may indeed start to have an impact on the economy later in 2025. I envision these possible changes have the potential to lower both inflationary pressures and deficit spending along with raising GDP growth rates. DOGE stands a chance of impacting 2025’s economic outcome.

Changes in tariff rates can happen this year, potentially driving inflation upward and economic growth downward, at least for a period. The timing and details of which are still in the wind.

Bottom line: It is still early in the Trump presidency, but we can count on an economic “cloud of dust” to accompany whatever progress/changes the current administration is able to accomplish. I suggest the majority economic changes, which may be forthcoming, will be felt primarily in 2026 and beyond.

Sources:

1Bureau of Economic Analysis: https://www.bea.gov/news/2025/gross-domestic-product-4th-quarter-and-year-2024-advance-estimate

2Bureau of Economic Analysis: https://www.bea.gov/data/personal-consumption-expenditures-price-index-excluding-food-and-energy

3 Associated Press: https://apnews.com/article/trump-tariffs-reciprocal-imports-tax-trade-economy-54c0a26687dc96157d96229068894720

This commentary is provided for informational and educational purposes only. As such, the information contained herein is not intended and should not be construed as individualized advice or recommendation of any kind.

The opinions and forward-looking statements expressed herein are not guarantees of any future performance and actual results or developments may differ materially from those projected. The information provided herein is believed to be reliable, but we do not guarantee accuracy, timeliness, or completeness. It is provided “as is” without any express or implied warranties.

There is no assurance that any investment, plan, or strategy will be successful. Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results, and nothing herein should be interpreted as an indication of future performance. Please consult your financial professional before making any investment or financial decisions.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.