Employment Picture Steady, Consumer Confidence a Question

The Federal Reserve lowered the federal funds rate by 50 basis points (bps) last month. This is the first rate decrease from the Fed following its multiyear period of raising rates in an attempt to bring inflation pressure to heel. The Fed believes inflation pressures have receded enough to justify moving rates back toward a more “neutral” stance.

History shows a recession has started within a year following the last three times the Fed has initiated a new rate-decrease cycle by lowering rates by 50 bps instead of 25 bps. The 2000, 2008 and 2020 recessions were all front-run by the Fed’s initial rate decrease of 50 bps.1

The question many are asking is: Is the Fed signaling rising concerns of economic weakening, suggesting a potential recession on the horizon?

Job Creation Is Key

To answer this question, I have to turn to fundamental economic data, with job creation levels being key to understanding the underlying momentum in economic activity.

As most readers know, I have written of growing concerns as to the sustainability of strong consumption demands as “excess” savings have evaporated2 and revolving credit utilization appears to be weakening3. These trends require the job market to remain robust and household income levels to carry the load of increased consumption spending levels. This is the stuff of our “Angels Flying Close to the Ground” economic theme this year.

Labor Market Slows, But Consumption Still “Reasonable”

The unemployment rate at the end of August was 4.3%, up from the April 2023 low of 3.4%.4 While the unemployment rate has risen, it is still lower than has historically been the case. Since 1990, the unemployment rate has averaged 5.7%.5

The number of jobs being created each month has slowed from the torrid pace reached over the last two years but remains reasonably sound. The latest report shows the number of jobs created in August was 142,000, down from a peak of 482,000 reached in December 2022 (last two years’ data) but up from an average rate of 120,000 from 1990 through 2024.6 As regular readers are aware, I tend to use the rolling three-month job creation data rather than the more volatile monthly data when looking at employment growth trends. The most recent rolling three-month average job creation rate was 116,000 as compared to the peak rate reached in January 2023 of 301,000 and the longer-term average (1990 through 2024) of 119,000.7 The recent release has been in line with the average growth rate seen over the last 30-plus years.

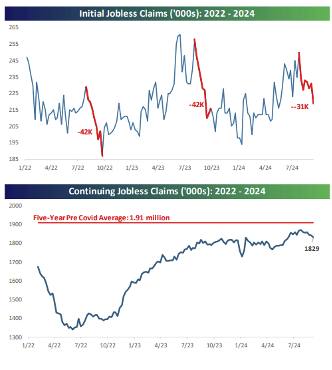

Finally, more recent initial jobless claims data shows a down leg (fewer initially unemployed) has occurred (see “Initial Jobless Claims” chart ). Additionally, the continuing-claim rates remain below the five-year post-COVID average of 1.91 million (see “Continuing Jobless Claims” chart).8

So, in summary, consumption activity remains reasonably good. I don’t want to say “strong,” but consumer spending trends haven’t been “weak,” either. Let’s call it “reasonable” and in line with our general thematic macro thoughts of “Angels Flying Close to the Ground.” The labor market is in a position to support consumption spending growth to a limited, reasonable level.

Willingness to Transact Weakening?

On October 1, the Conference Board released data from its August Consumer Confidence Index. For September, the overall index came in at 98.7, lower than expected and down significantly from August’s 105.6 reading. The decline was the largest since August 2021. It was the steepest for consumers aged 35 to 54 and for those making incomes of less than $50,000 per year.

Both the “Present Situation” and the “Expectations” indexes declined. The Present Situation Index was 124.3 compared to the previous reading of 134.6. The Expectations Index was 81.7 versus 86.3 a month earlier.

How to interpret this information? For a transaction of any sort to take place, both the ability and willingness to transact need to be present. Consumer confidence data is an indication of the “willingness” to transact. Is this weakening? One month’s data doesn’t make a trend, but the level of this confidence decline is worth noting.

Expect Lower Rates as Economy Slows

In the meantime, we continue to expect to see gross domestic product (GDP) growth rates slow to the 1.5% to 2.0% range, down from the 2.1% rate we saw in the first half of the year.9 Inflation rates continue to slow as well. The combination of a downshift in growth and inflation is allowing the Fed to bring short-term (federal funds) rates down.

How far are rates going to fall? Nobody (including the Fed) knows. But its latest “dot plot” (survey results from its own internal estimates) suggests short-term rates are expected to fall from today’s 4.87% (mid-range) to 4.37% by the end of this year and to 3.37% by the end of 2025.

As economic growth cools, we expect to see the Fed stay true to its word that rates should continue to return to a more “neutral” stance.

Sources:

1Conference Board

2San Francisco Federal Reserve

3-7St. Louis Federal Reserve

8Bespoke

9St. Louis Federal Reserve

This commentary is provided for informational and educational purposes only. As such, the information contained herein is not intended and should not be construed as individualized advice or recommendation of any kind.

The opinions and forward-looking statements expressed herein are not guarantees of any future performance and actual results or developments may differ materially from those projected. The information provided herein is believed to be reliable, but we do not guarantee accuracy, timeliness, or completeness. It is provided “as is” without any express or implied warranties.

There is no assurance that any investment, plan, or strategy will be successful. Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results, and nothing herein should be interpreted as an indication of future performance. Please consult your financial professional before making any investment or financial decisions.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.