In The End, Rational Thinking Prevails. We’re Maintaining Our Constructive Thesis.

“It doesn’t matter how smart you are unless you stop and think.”

—Well-known economist Thomas Sowell

Nothing like a little head-spinning drama, eh? That’s what we saw in August as virtually one or two slightly disappointing economic numbers sparked a more than 10% pullback in the technology-laden Nasdaq and pushed the S&P 500 down close to 10% retrenchment territory from recent highs. No fun, but normal temporary corrective price behavior, in our view.

We have been clear in telling clients and the marketplace that we feel the early August swoon was a huge overreaction and nothing like the beginnings of a bear market phase. The pullback starting in the final days of July and extending through August 5 was triggered, out of the blue, by a couple of softer-than-expected economic releases: a report about manufacturing activity that showed demand in the goods sector is softening and the July payroll report that suggested while new jobs are still being created at decent levels (despite a hurricane-challenged month that can skew the data), the pace of job growth is decelerating.

Neither one of these data points was recessionary in nature, but they do support the thought that the economy is slowing a tad. Importantly, isn’t this what we all wanted (a modest deceleration in robust job gains and economic growth) so that the Federal Reserve could begin to cut?

Data an Aberration, Not Signals of a Recession

Regardless of your response to this rhetorical question, there is no reason to leap to the conclusion based on these reports that a recession is imminent. The data doesn’t support doing so. On the heels of such robust returns in 2023 and in the first seven months of 2024, any hint of moderation in growth can lead to exaggeration and overreactions. Particularly when a couple of disappointing data points are accompanied by ugly political rhetoric, threats of retaliation in the Middle East and mentions of an odd-yet-temporary unwind of some yen carry trades that capture headlines.

Unfortunately, the bear camp used the economic reports to trumpet renewed warnings of looming recession and encourage investors to adopt a “ready, shoot, aim” mentality via trimming stock exposure. Our take? The market endured a week or so at the beginning of August of odd and off-putting headlines that when coupled with these isolated, disappointing economic releases spooked investors … simple as that. These two reports look like one-off aberrations to us. We would emphasize that only one month’s worth of a couple of economic figures that are merely a touch shy of expectations a trend does not make!

Subsequent August releases of broader economic data reported over the past several weeks confirm this—to wit, the healthy unemployment claims data, solid retail sales, upward revisions to Q2 gross domestic product (GDP) to the 3% level, continued calming in inflation toward Fed target levels, reaccelerating labor productivity and impressive growth in personal disposable income and spending, etc. The mosaic still describes a soft landing with easing inflation and continued economic growth. Kudos to the Fed for successfully, thus far, battling inflation largely induced by the pandemic and getting it under control without inspiring a recession of the hard landing variety. That is not easy to do.

Our “Back to Normal” Thesis Remains Intact

Apparently, investors’ emotional urges to sell vanished rather quickly by mid-August as the plethora of offsetting and positive data was distributed throughout the month on the heels of the first week of underwhelming news. Investors seemed to snap out of their “ready, fire, aim” mood swiftly, think more deeply as they digested the additional fundamental news flow that signaled continued positive trend in earnings and the economy and appreciate the constructive mosaic we outlined above.

Enthusiastic buying came back into the stock market in the second half of the month following those first rough couple of days in August. The S&P 500 ended up gaining 2.4%1 in a month that historically tends to be one of the top three worst calendar months for generating negative returns2. As a result, the S&P 500 stands only roughly 0.5% below its all-time high on July 16 and is up more than 17% for the year.3 Not bad!

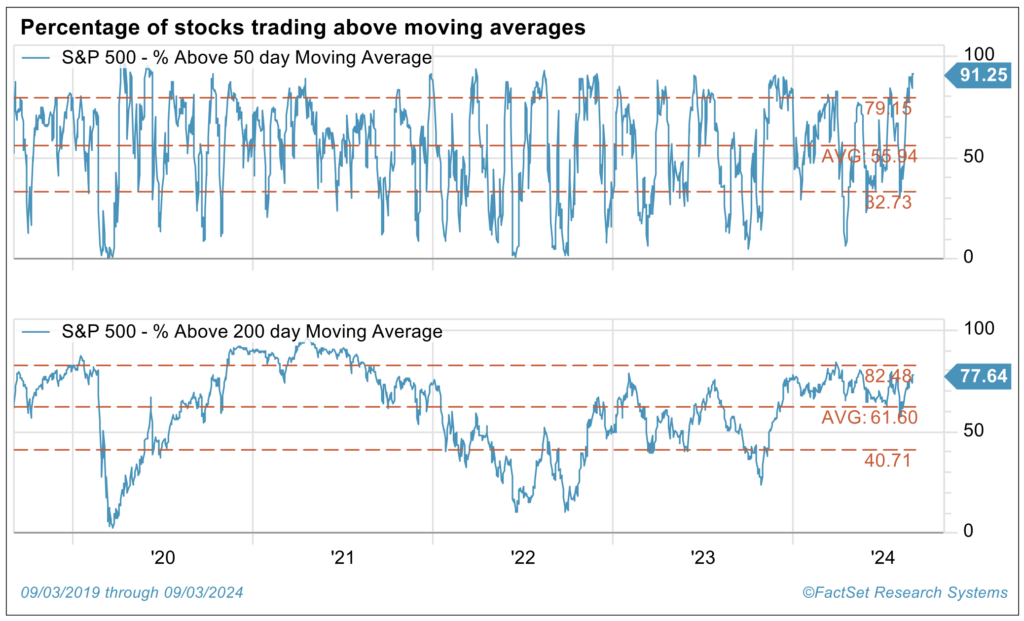

Healthy Signs of a Broadening Market

Impressively, the market broadened out handsomely as the month evolved, as illustrated by the equal-weighted S&P 500 index outpacing the capitalization-weighted S&P 500; the sharp rise in the percentage of stocks trading above their 50- and 200-day moving averages as we moved to month-end; the expansion in the number of sectors demonstrating leadership to include financials, utilities, consumer staples and REITs as opposed to past dominance of primarily technology and communication services; and finally, a surge in the number of stocks advancing versus declining. On this latter point, the New York Stock Exchange advance-decline line has reached new highs before the S&P 500 has reclaimed record highs, meaning that breadth or participation in the advance is stronger than the magnitude in the price advance. This is a very healthy sign.

Bottom line, as suggested in our quote at the top of this commentary, investors seemed to start thinking rationally as we moved through August based on the real facts or trend in the broader data. Rational thought that seemed to be missing at the beginning of the month prevailed by month-end. That’s the stock market!

Early August Pullback – Déjà Vu All Over Again?

The performance pattern that has developed in 2024 inspires us to channel Yogi Berra and one of his timeless observations that it looks like “Déjàvu all over again!” Last year, just like what we have witnessed so far in 2024, the S&P 500 was on a tear in the first seven months. The market ripped to roughly 15% gains during that time and achieved our 2023 calendar year-end target ahead of schedule (sound familiar?). Then in August of 2023, one “bad” economic number was released … a disappointing inflation (Consumer Price Index (CPI)) number was reported and inspired an 11% sell-off from the last week of July through mid-October. Back then, all eyes were on inflation and just one less-than-perfect report inspired temporary panic.

When later CPI numbers came out, they proved the weak August figure to be a head fake, and the market surged in the final two months of 2023, making for the best Santa Claus rally on record and a great calendar-year return of 26% last year. It was by no means a straight shot and smooth ride to +26% in 2023.4

What is the parallel scenario we see for this year or the déjàvu pattern we see potentially developing in 2024? After the market surged to new highs and robust double-digit returns in the first seven months of 2024—besting even the momentum in the early going in 2023—a disappointing economic number was released in August of this year, as we’ve mentioned. With all eyes on growth and employment now versus inflation trends last year, we got a “bad” number in July’s employment report released on Friday, August 2 (specifically, only 114,000 jobs were created rather than the forecasted monthly figure of 175,000; this may well be revised up, by the way, in future reports).5 As we stated earlier, this was hardly recessionary data, but not as strong as expected. In response, investors overreacted, in our view, as the market swooned temporarily by almost -10% from 2024 highs (again, sound familiar?).

The Rest of the Story Looks Positive

As Paul Harvey might encourage us to think about, what might be “the rest of the story” in 2024? What might the final chapter of the déjà vu narrative look like?

We remain positive about anticipated 2024 and 2025 stock market returns given that fundamental trends in 2024 remain positive like they did in 2023 in the face of persistent wall of worry items and associated bouts of investor angst. The final months of 2024 might reflect what we saw in 2023’s strong finish and what generally happens after elections conclude in presidential campaign years. This could be true regardless of whether this plays out via recovery from additional temporary pullbacks we might endure this fall or if investors get giddy when the Fed begins cutting and push gains toward the 6,000 threshold we are looking for by mid-next year, earlier than we expect.

Better Positioned to Weather a Recession Than a Year Ago

We would add that this seeming recession-phobia amongst the bear camp is a bit misguided, in our view. We don’t say this just because recession is not our base case view. Yes, we expect U.S. real GDP to grow by roughly 2% in 2024 and to continue to advance in 2025, but if we are wrong and the economy slows to a level below our expectations, the financial markets are in a much better place to absorb a normal, mild downturn than we were this time last year or the not-too-distant past when many folks thought recession was highly probable in late 2022 and throughout 2023.

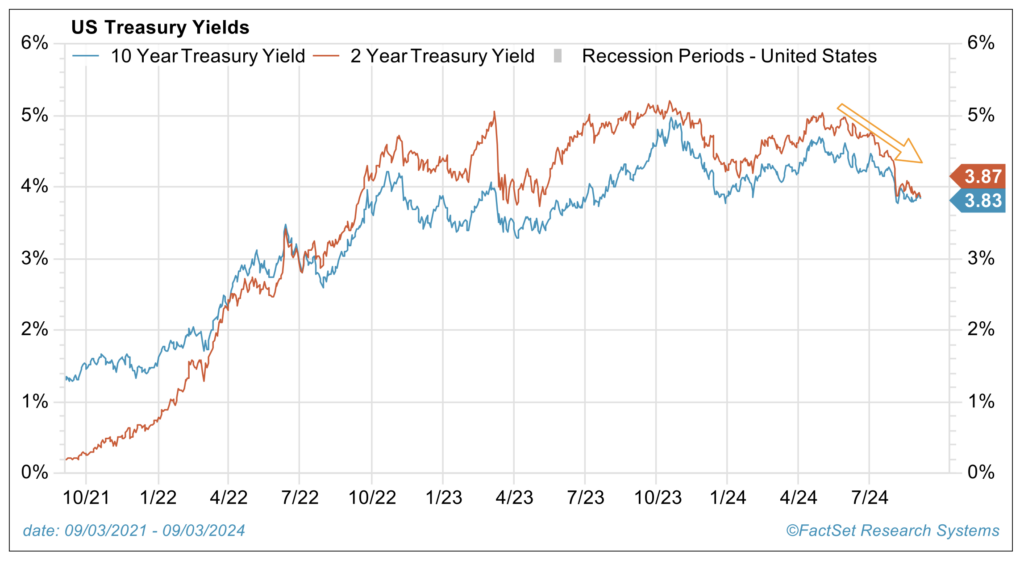

Even if a recession does develop now, it doesn’t spell scorched earth for stocks, in our view. You still can’t jump to the conclusion that this will result in a bear market for several reasons. First, history tells us that the stock market advances almost half of the time in the midst of recessions. Second, the Fed and interest rate trends are just far more supportive and free to play the role of automatic stabilizers this year should we slip into a mild recession compared to their lack of a potentially healthy “cavalry to the rescue” role last year when most of the world thought risk of recession was far higher than now.

When many were forecasting recession last year, the Fed was knee deep in its battle with inflation and signaling major hikes; the 10-year Treasury and mortgage rates were on the rise. Such trends only worsen or extend a recession. This year the Fed is signaling rate cuts, and the 10-year Treasury has fallen to handsomely below 4%. It’s worth noting these are important counterbalances and positive pillars of support to earnings and the housing market should a recession surface now, even though recession is not our base case.

Wrap-Up

If you have been following the team’s outlook or watched Mariner’s Midyear Crystal Ball webinar, you’ll know that we have been holding steady with respect to our year-end S&P 500 price target of 5,400 despite such a strong front-end-loaded advance for the index. We have felt that our 5,400 targeted price level represents a reasonable price-to-earnings multiple applied to a likely and healthy earnings-per-share figure for the S&P 500. It also would result in a productive 14.5% total return on stocks for calendar year 2024 to boot should the index indeed rest there at year-end. I think we’d all agree that would make for a solid year.

Further, based upon the continued healthy mosaic of fundamental, valuation and technical data on which we base our investment decisions and forecasts, we have introduced a price level target of 6,000 for the S&P 500 by the second half of 2025. That said, we don’t expect a straight uninterrupted shot to the 6,000-plus threshold. Given a fairly long list of wall of worry items in the headlines that can push investor psychology around on a temporary basis—items ranging from a contentious presidential political race to geopolitical conflict in several areas to continued armchair quarterbacking about appropriate Fed policy—we have been saying we would not be surprised by a normal, healthy market correction to the tune of 10% to 15% prior to hitting those anticipated 2025 new highs. So, we could see additional drawdown moments like we just witnessed in early August before the year concludes and achieve sustained higher price levels.

Normal corrections are part of our back to normal thesis and our still-constructive view on the U.S. equity market over the next 12 to 15 months. If one studies history, one will note that the market has a double-digit intrayear pullback annually on average, and these are just part and parcel of a normal bull advance in the market. Active stock selection can add value in moments of volatility as markets churn and grind higher.

Sources:

1-4FactSet

5Bureau of Labor Statistics, July employment report

This commentary is provided for informational and educational purposes only. As such, the information contained herein is not intended and should not be construed as individualized advice or recommendation of any kind.

The opinions and forward-looking statements expressed herein are not guarantees of any future performance and actual results or developments may differ materially from those projected. The information provided herein is believed to be reliable, but we do not guarantee accuracy, timeliness, or completeness. It is provided “as is” without any express or implied warranties.

The S&P 500 is a capitalization-weighted index designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The S&P 500 Equal Weight Index is designed to track the equally weighted performance of the 500 stocks in the S&P 500 Index. The indexes referenced herein are unmanaged and cannot be directly invested in.

There is no assurance that any investment, plan, or strategy will be successful. Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results, and nothing herein should be interpreted as an indication of future performance. Please consult your financial professional before making any investment or financial decisions.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.