Key To A Healthy Portfolio: Seek Balance

Will It Be Feast Or Famine In Retirement?

Contributing to your employer’s retirement plan is an important step toward a potentially secure retirement. The types of investments you choose in your retirement account may also determine what your retirement lifestyle will be. It could be a factor in deciding between the value menu or steak for dinner.

Your Investment Menu

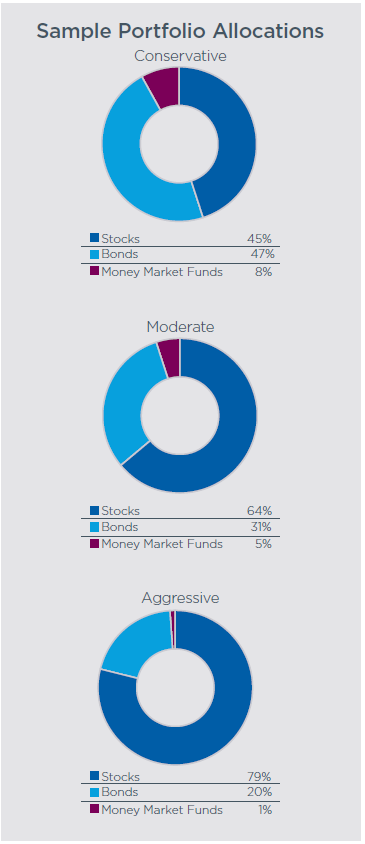

Choosing investments requires careful attention. Your portfolio generally should include various types of investments, like stock, bond and money market funds, which are expected to perform differently during particular economic conditions. Spreading your investments across the different types of investments is known as diversification. How much of your portfolio is invested in each type is your asset allocation.

Your asset allocation decision can have a large impact on how fast your retirement account grows. With a good asset allocation mix, a decline in any single type of investment has less of an impact on your overall portfolio and may be offset by increases in other investments, though asset allocation alone cannot ensure against loss.

Dividing Your Portfolio Plate

What’s on your portfolio plate depends a lot on what’s unique about you. A financial professional can help you make asset allocation decisions. Before you talk to an advisor, it may help to understand what your investment choices should be based on. Following are two factors that should influence your decision.

How Much Time?

Your age and how long you have to retire can help you determine what percentage of your investments should be allocated to each asset type. Generally, the longer you have until retirement, the more risk you can take. Since stock funds inherently have more risk, you can allocate more of this asset type if you have longer to invest.

How Do You Feel About Risk?

Your risk tolerance is how you feel if the value of your investments change due to market conditions.

People with higher risk tolerances are less likely to panic if there’s a sudden drop in their portfolio value, and can probably stand to have a greater percentage of stocks.

People with lower risk tolerances should probably stick with a slightly lower percentage of stocks, but not so little that they hinder potential portfolio growth

Revisit

While you want to take a long-term view of your investments for retirement, once you have your asset allocation in place, it’s a good idea to review it from time to time. As you get closer to retirement you will want to consider your time horizon, and you may find your risk tolerance changing too. Changing market conditions over time can also be a good reason to review your asset allocation.

The Bottom Line

A healthy asset allocation is similar to eating a well balanced diet. It may take some discipline, but the payoff in risk reduction may help protect your portfolio and ultimately, your retirement dreams.

Diversification does not assure a profit nor does it protect against loss of principal.

This material is provided with permission from American Century. It is for informational purposes only and has been obtained from sources believed to be reliable. While every effort is made to ensure the accuracy of its contents, it should not be relied upon as being tax, legal, or financial advice.

American Century Investment Services, Inc., Distributor

© American Century Proprietary Holdings, Inc. All rights reserved.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.