Multigenerational Wealth Planning for the Sandwich Generation

Known as the sandwich generation, some adults in their 40s and 50s find themselves covering expenses like health care and rent for an adult or minor child plus an aging parent. This challenge can cause financial stress. If you find yourself in this category, consider a multigenerational wealth plan to help ensure everyone is taken care of today and in the future.

The Sandwich Generation: Who Are They?

About a quarter of U.S. adults (23%) make up the sandwich generation.1 What’s more, 27% of wealthy individuals find themselves sandwiched between an aging parent and their children.2

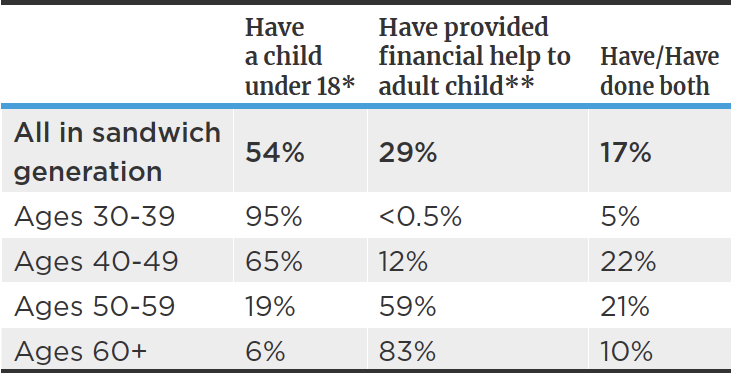

*And have not provided financial help to an adult child. ** And do not have a child younger than 18 years old.

Note: Adults in the sandwich generation are those who have a living parent age 65 or older and are either raising a minor child or have provided financial support to an adult child in the year prior to the survey. There were too few adults younger than 30 in this group to analyze separately.

Survey of U.S. adults conducted Oct. 18-24, 2021. Source: Pew Research Center

Put Your Future First

Although it’s natural to want to temporarily set aside your future goals to focus on the needs of your parents and children, consider meeting with your wealth advisor to ensure your savings goals are on track and to make the most of the retirement accounts and strategies available to you.

- Take advantage of nonqualified plans. For highly compensated employees who have maxed out allowable yearly contributions to qualified plans, employers may offer these employees the opportunity to enroll in a pre- tax nonqualified deferred compensation plan (NQDC). Note that while deferring a portion of your income comes with tax benefits, there are also risks. An NQDC is an unsecured promise by your employer to pay out your account balance in the future—meaning you could lose some or all your assets if, for example, your employer files for bankruptcy.

- Open a health savings account. If your employer offers a health savings account, you can use HSA funds to pay for eligible medical expenses. To qualify for an HSA, you must be enrolled in a high- deductible health plan. HSAs offer multiple tax benefits, are portable from employer to employer and, once you reach age 65, you can use your HSA funds for nonmedical retirement expenses.

- Plan for long-term care. Seven out of 10 Americans who reach age 65 will need long- term care in their lifetime3—and the cost of that care can be significant. Consider that the annual national median cost for a private room in a nursing facility in 2021 was $108,405.4 There are several options for covering these expenses for yourself and for aging parents:

- Pay for long-term care from private funds. You may choose to self-finance long-term care for yourself and/or your parents

- Fund a new, permanent life insurance policy with a long-term care rider. You can do this using the surrender value of an older policy without triggering taxes. Your monthly payments from the rider, which you can tap into to pay your long-term care expenses, are subtracted from the policy’s death benefit.

- Convert a variable annuity to an annuity with long-term care benefits. To help pay for a parent’s care, you could convert all or a portion of the gains accumulated in a variable annuity into an annuity with long-term care benefits. This process is known as a 1035 exchange. Although you are the insured individual, you can change the beneficiary to a parent. Plus, a 1035 exchange is the only way to access gains in an annuity tax free.

- Superfund a 529 plan. If you’re still raising a minor child or already have grandchildren, you may already be funding a tax-advantaged 529 plan to pay for qualified education expenses. To maximize this strategy, think about superfunding a 529 plan, which lets you make a large, lump- sum contribution while avoiding gift taxes and protecting your lifetime gift and estate tax exemption. The IRS allows couples to contribute up to $170,0005 (the 2023 annual gift-tax exclusion multiplied by five) and treat the onetime contribution as being spread over five years for tax purposes.

Keep Estate Plan Documents Current

In addition to the financial aspect of taking care of aging parents, make sure they have an updated estate plan in place that includes current beneficiaries and appropriate trusts for the transfer of wealth.

If you’re covering expenses for a parent, it’s a good idea to talk with them about making you a financial power of attorney if you aren’t already named. And be sure that you are a backup power of attorney for health care should one of your parents become incapacitated and the other parent is unable to make decisions on their behalf.

Teach Your Children Financial Independence

If you have a child who’s left the nest and then returned home out of financial necessity, you know the challenges young people face today when it comes to being a financially independent adult.

Children of any age can be taught the basics of budgeting, saving and investing. If you still have minor children at home, you can teach them by the example you set in managing your own finances. Help them establish good saving habits by, for example, setting up a savings account at your local bank and then having them continue to fund it with an allowance or the salary from a job. College-aged children are old enough to open their own credit card accounts, so you’ll want to encourage them to pay their bill off in full every month to avoid high interest rate charges.

If you’re helping grown children finance a car purchase or a mortgage down payment, use that as an opportunity to discuss the importance of setting up an emergency fund and saving for retirement. And if your children will eventually receive an inheritance from you, start to have family conversations early on about your plans so they’ll be prepared to make prudent decisions about those assets when the time comes.

We’re Here to Help

At Mariner, our in-house wealth, insurance, investments, retirement planning and estate planning teams have the knowledge and experience to help you create a wealth plan that meets your family’s needs.

Sources:

3,4“Genworth Cost of Care Survey.”

This article is limited to the dissemination of general information pertaining to Mariner Wealth Advisors’ investment advisory services and general economic market conditions. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on information and sources of information deemed to be reliable, but Mariner Wealth Advisors does not warrant the accuracy of the information that this opinion and forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.