Our 2024 View: Overall Economic Growth Is Slowing

Read time: 8 minutes

For those who didn’t experience “The Tonight Show Starring Johnny Carson,” he used to do a bit in which he played Carnac the Magnificent, who could psychically “divine” answers to unseen questions.

At times I feel as if I’m Carnac as I attempt to forecast economic outcomes. With 2024 within sight, I am sharing some evidence that overall economic growth is slowing. I am also suggesting next year’s environment may allow the Federal Reserve to pivot monetary policy toward ease and away from a restrictive policy. And as far as our economic view for 2024, in a nutshell, we see a slowing economy in which both growth and inflation pressures may subside.

Boom Phase to Slow?

Growth resembled “boom” status during the third quarter, with the economy growing by 5.2% (“real,” annualized).1 This was a blowout number, as the average quarterly (“real,” annualized) gross domestic product (GDP) growth rate has been 3.1% since 1947.2 The quarterly 5.2% growth rate was the strongest growth our economy has seen for almost 10 years, since 2014.3

Over a full economic cycle, the economy typically experiences four stages: recovery, expansion, boom and recession. The boom phase tends to precede a slowdown, as the growth rate tends to prove to be unsustainable. Given past standards, a GDP growth rate of 5.2% has been unsustainable. It feels like a boom phase has occurred.

That said, I’m seeing more evidence that the torrid growth pace the economy posted in the third quarter of this year is moderating. Remember that almost a full 1% of the 4.9% posted GDP growth rate during the latest quarter was due to inventory build, which will likely be reversed over the next couple of quarters. In addition, a significant portion of the reported growth rested in a surge in government spending and not within the private sector of the economy, which leads one to the conclusion that the quarter’s growth wasn’t as robust as initially advertised.

I don’t want to throw cold water on the state of our economy. Our growth rate is fine and higher than many of us were expecting this year. The sustainability of growth driven primarily by extraordinary government transfer payments in the trillions of dollars that started during the pandemic and continued into the year following the pandemic has allowed the economy to retain a growth edge—even in the face of the most robust monetary tightening policies initiated by the Fed since the dark days of Fed Chair Paul Volcker’s historic anti-inflation fight during the early 1980s.

Evidence of Upcoming Slowing Growth

I continue to see evidence that, yes, the overall growth rate in the economy seems to be slowing. Growth remains positive, but the overall trend seems to be one of weakening strength. Consider these factors:

- A true strength of the current cycle has resided in the durability of the labor market. As of October 2023, the unemployment rate was 3.9%,4 up from the low we saw in April of this year when the rate was 3.4%.5 To put this in perspective, the average unemployment rate since the end of World War II has been 5.7%.6 So, while the rate has increased by 0.5% over the last half year, it is still much lower than has historically been the case throughout many business cycles.

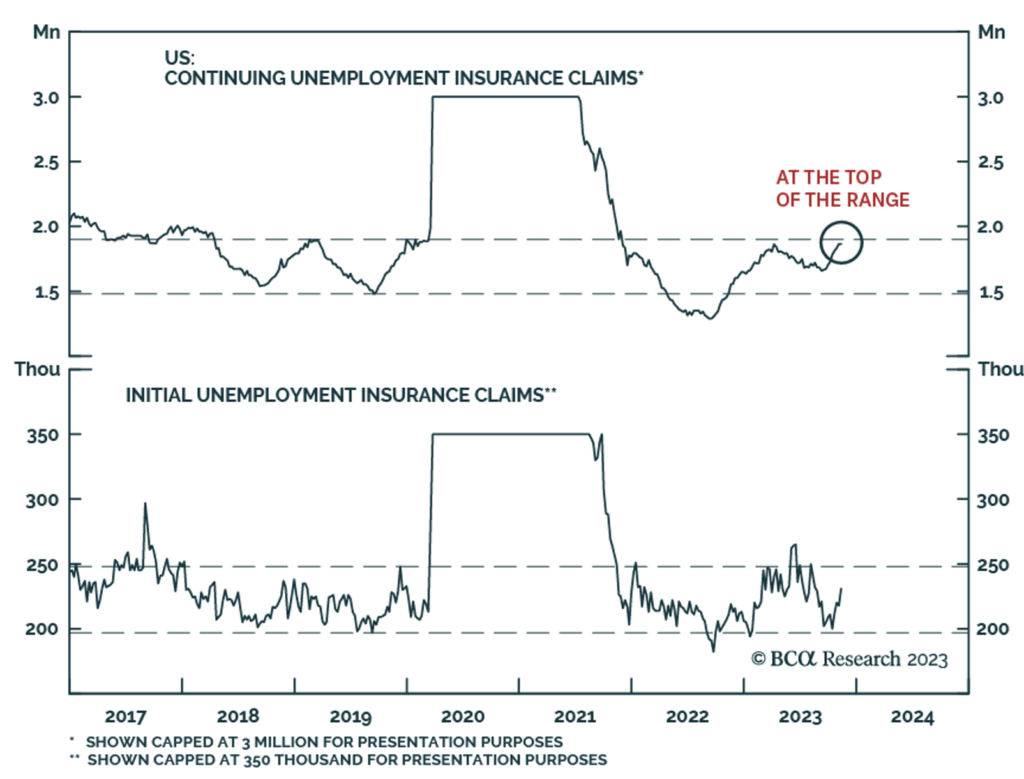

- That being said, continuing unemployment claim data has recently been deteriorating, providing a sign that the labor market is starting to appear winded (see chart below), as continuing unemployment claims are the highest that we have seen in almost two years.

- The demand for capital is slowing. The Fed’s attempts to slow overall economic activity seems to be gaining traction. The second chart below shows the volume of new mortgage applications in gray with the yellow line showing 30-year mortgage interest rates over a 20-year period. As noted, mortgage applications are lower than at any time over the last 20+ years, as mortgage rates are at the same level we saw at the turn of the millennium.

- In addition to low demand for mortgage capital, the folks at Ned Davis Research report that new credit card applications are down 9.1% over the last three months, and applications for new auto loans are down a sizable 24.4% over the same period.

- The percentage of banks tightening lending standards for consumers is now at 29% for credit cards and 15% for auto loans.7

- Turning the page to commercial lending activity, real estate lending standards have tightened at 65% of banks, while demand for new construction/development loans has contracted by 52%, according to the latest senior lending officer filings. It appears the availability and demand for capital has been contracting over the last three months or so. As credit demands weaken, so does overall economic growth.

Source: Bank Credit Analyst Research

If we dig into consumer activity, the latest data suggests consumers are spending more on essentials and less on discretionary items. Vehicle sales were down in October, and the Atlanta Federal Reserve “GDP Now” modeling is suggesting fourth quarter GDP may be reported at +2.2% versus the blistering pace of +4.9% set in the third quarter. Still a good growth rate, but one that appears to be weakening.

What’s Next?

Will we slip into a recession as the new year approaches? I don’t know, but it seems a shock would be necessary for the economy to lose that much momentum that quickly. While I can’t see around corners, if a recession is in the cards, it may not occur until later in 2024. Recently I penned my view that GDP growth would remain positive next year, growing at a 1.5% annualized pace. If we do see a recession unfold next year, at this time it appears that the duration and depth of the downturn is expected to be brief and rather shallow.

Source: Mortgage News Daily

In the meantime, I am maintaining my call that GDP growth will be in the 1.5% range for all of next year as compared to the long-term average annual growth of 3.1%.8

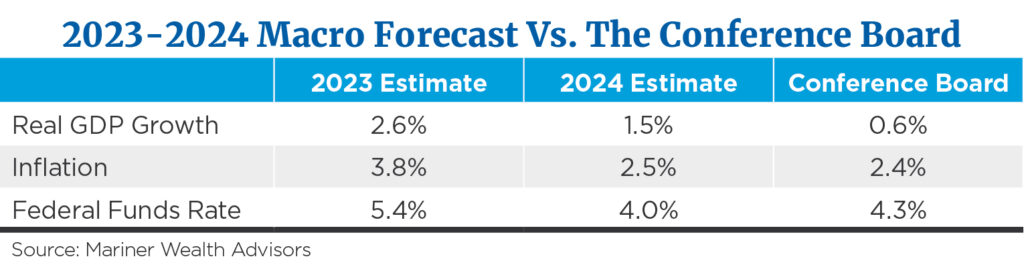

One spot of good news is if economic growth continues to show signs of slowing, the Fed may be done with its tightening policy applications for the time being. Next year I suspect we will see an inflation print in the 2% or so range, as economic growth weakening should continue to lead to lower inflationary pressures. I suspect we will see further improvement in interest rates as 2024 unfolds. My call is for inflation to reach 2.5% next year.

With 2.5% inflation on the horizon and real GDP growth at 1.5%, the Fed, in an attempt to neutralize monetary policy, may target a federal funds rate of 4.0% sometime next year as compared to 5.33% as of Nov. 30, 2023.9 My core expectation next year contains a Fed policy pivot to occur, with short-term interest rates trading lower at the end of the year than at the beginning. Below find macro items in my forecast for 2023/2024 as compared to the Conference Board’s thoughts.

The Fed’s 2% inflation target needs discussion. When Chairman Powell talks about 2% inflation, does he mean 2%—or a little more than that? If economic growth weakens enough next year, and unemployment grows toward the 5% target, which I am anticipating, I think the Fed will “blink” and start to bring short-term rates downward. Only time will tell.

Sources:

2,3St. Louis Federal Reserve

4U.S. Department of Labor, October 2023 data

5U.S. Department of Labor, April 2023 data

6St. Louis Federal Reserve

7Ned Davis Research

8St. Louis Federal Reserve

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.

This commentary is for informational and educational purposes only and is limited to the dissemination of general information pertaining to Mariner Wealth Advisors’ investment advisory services and general economic market conditions. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment, or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on the information and sources of information deemed to be reliable, but Mariner Wealth Advisors does not warrant the accuracy of the information that any opinion or forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Consult your financial professional before making any investment decision.