Protecting the Value of Cash Against Inflation With I Bonds

Series I savings bonds are 30-year bonds issued by the U.S. government designed to keep up with inflation. The bond structure combines a fixed interest rate with a variable interest rate adjusted for inflation, referred to as the inflation rate. The fixed rate is set when purchased and will never change throughout the duration of the bond.

However, a new fixed rate is set every six months, in May and November, by the U.S. Treasury Department for newly issued Series I bonds. The inflation rate can, and usually does, change every six months, in May and November. The change is based on the non-seasonally adjusted Consumer Price Index for all Urban Consumers (CPI-U) for all items, including food and energy. The variable inflationary rate is effective the first day of the month in which the bond is purchased and remains in effect for six months.

How to Purchase

All Series I bonds must be purchased on TreasuryDirect.gov, as these bonds cannot be bought nor sold on the secondary market. A purchaser will need a tax ID, email address and bank account information when setting up an online account.

An individual may purchase any denomination of electronic Series I bonds up to $10,000 per calendar year, with a minimum investment of $25. The cost for Series I bonds is the face value of the bond. Electronic Series I bonds can also be given as a gift, with the recipient limited to the same $10,000 amount annually.

In addition to the $10,000 purchase limit, an individual can acquire up to $5,000 in paper Series I bonds when filing a federal income tax refund. Use IRS Form 8888 and choose the Series I bond amount in $50 increments. The issue date will be the first of the month in which the IRS submits payments to the Treasury Retail Securities Site.

Series I bonds pay interest in full for the first month, regardless of the purchase date during that month. Therefore, one strategy is to purchase Series I bonds toward the end of the month if possible. Plan accordingly to ensure Treasury Direct has at least 24 hours to process the transactions. When it is time to redeem Series I bonds, it is better to do so at the beginning of the month because they don’t provide partial interest for the month.

Determining Value

An investor determines the actual interest rate (composite rate) by combining the fixed rate and inflation rate.

For example, if an investor purchased $10,000 of Series I bonds at the 7.12% annual rate in January 2022, then in May the annual inflation rate jumped to 9.62%, the investor will earn the semiannual rate of 3.56% from January 2022 through June 2022 and the semiannual rate of 4.81% from July 2022 through December 2022.

The estimated future value of the investment after one year uses the following formula:

$10,000 * (1 + 0.0712/2) * (1 + 0.0962/2) = $10,854

As a result, the annualized rate of the investment purchased in January 2022 is 8.54%.

Considerations when determining value:

- The composite rate is applied for the first six months after the purchase is made.

- The interest earned is equal to half the stated composite rate with interest being credited on the first day of each month (see formula above).

- The bond interest is earned monthly but compounded semiannually.

- An investor must hold Series I bonds for at least 12 months prior to redeeming.

- There is also a three-month interest penalty if redeemed before five years from purchase.

The value of Series I bonds can be reviewed on the Treasury Direct website (www.treasurydirect.gov), under the Current Holdings tab. Treasury Direct displays the current value with the three-month penalty automatically reflected. Therefore, an investor will not see accumulated interest until the completion of the fourth month holding period (visible the first day of the fifth month). The three-month penalty automatically goes away after five years.

One strategy for estimating a more accurate annual return is to purchase Series I bonds toward the end of April or the end of October. At that point, investors can study projections of the new inflation rate listed in the monthly inflation report from the U.S. Bureau of Labor Statistics. The report is typically available a couple of weeks prior to the official reset in May or November and should provide an indication of the upcoming inflation rate.

Incorporating Into a Portfolio

Series I bonds are considered safe investments because they are backed by the full faith and credit of the U.S. government. The downside to Series I bonds is that they only keep up with inflation. They do not provide a real return if fixed interest rates are at 0% and, historically, have lagged stock market performance. Due to their liquidity limitations within the first year, it is not advised to use Series I bonds as an emergency fund. Investors should ensure they still have the necessary three to six months of emergency funds in place before considering purchasing Series I bonds.

Tax Implications

Series I bond interest is only subject to federal income tax, not state or local income tax. Interest can be reported in multiple ways:

- Report interest income every year, or

- Defer reporting the interest until a federal income tax return is filed for the year in which the first of these events occurs:

- Redeem the bond to receive what the bond is worth

- Give up ownership of the bond and the bond is reissued

- The bond stops earning interest because it has reached its final maturity

To redeem bonds, log on to Treasury Direct and use the link for Manage Direct. A minimum of $25 is required to cash out an I bond. Redemptions consist of principal and interest; however, a partial redemption only pays out interest. Forms 1099- INT are posted on Treasury Direct in January to be used for filing taxes. Consult with a tax advisor to determine the optimal tax strategy.

Education Tax Exclusion

Series I bonds can be redeemed to pay for qualified education expenses with interest earned being excluded from taxable income. Qualified education expenses include tuition and fees. Room and board are not permitted expenses.

The calculation to determine the interest that can be excluded from income is:

(Qualified Education Expenses/Bond Redemption Proceeds) * Interest Income = Excludable Interest

To receive the income exclusion benefit, the following must apply:

- The bond must be purchased in the name of the parent (or parents).

- The bond must be issued to an owner at least 24 years old at the time of purchase.

- The bonds must be redeemed in the year that qualified education expenses are incurred.

- The qualified education expenses must be for the taxpayer, the taxpayer’s spouse or dependents of the taxpayer.

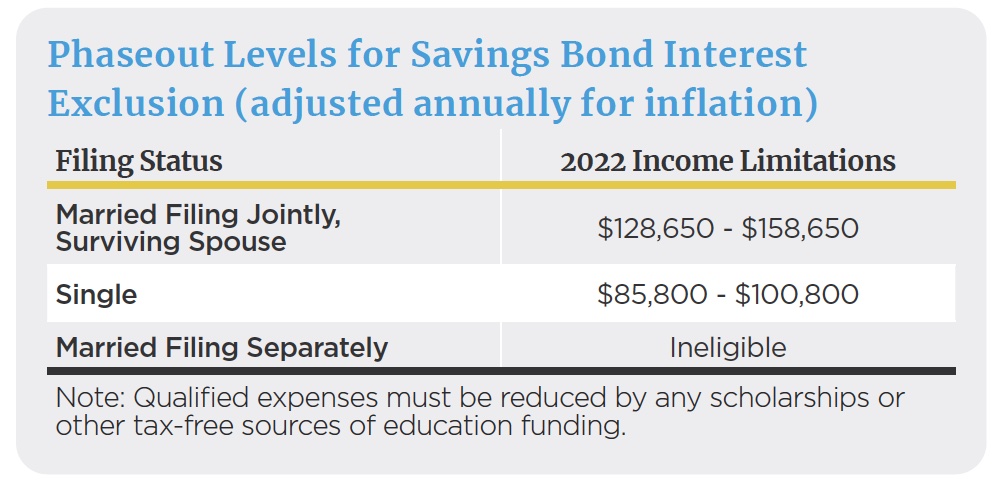

Use modified adjusted gross income (MAGI) to determine whether the investor is eligible for the interest income exclusion.

529 Plans

In addition to the ability to exclude the interest earned on bonds in the year qualified education expenses are incurred, owners of the bonds may roll over the bonds into a college savings plan (529 plan). Rollovers must occur within 60 days of redemption and within the same tax year. Series I bonds are deemed assets of the bondholder for financial aid purposes. 529 plans have a broader set of qualified higher education expenses. A savings bond rollover is reported on IRS Form 8815.

Investors should consider the investment objectives, risks, charges, and expenses associated with 529 plans before investing. More information about specific 529 plans is available in each issuer’s official statement, which should be read carefully before investing.

This material is intended for informational and educational purposes only. It should not be construed as investment or tax advice or a solicitation or recommendation to purchase any investment product. Any opinions expressed are subject to change without notice.

The information contained herein is taken from sources believed to be reliable. However, accuracy or completeness cannot be guaranteed. Please contact a financial or tax professional regarding your personal circumstances before making any financial-related decisions.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.