Santa Hit Some Air Turbulence at Year-End. Time for a Rest? Buckle Up!

Read time: 12 minutes

“The greatest danger in times of turbulence is not the turbulence; it is to act with yesterday’s logic.”

— World-renowned management consultant and author Peter Drucker

From an investment return standpoint, 2024 was virtually a replay of 2023. Specifically, the S&P 500 returned a total of 25.0% in calendar year 2024, almost identical to 2023’s 26.3% total return.1 We’re gratified that many components of our crystal ball outlook that we outlined back in January last year came to fruition as we turned the pages of the calendar.

Specifically, the market even outdid the robust returns we anticipated. We projected a 2024 year-end S&P 500 price target of 5,200 in our base case (with upside to 5,400 in our optimistic case), which represented a forecast of solid double-digit gains for equity investors. While the actual ending price level of 5,882 made us look like slight underachievers regarding return expectations, we were at the top of the heap on the Wall Street strategists’ list of S&P 500 price targets.2

We certainly got the positive trend right. We find this rewarding, particularly when coupled with our ultra-contrarian bullish call in 2023 that found us far atop the list of strategists’ targets going into that year as well when deeply bearish sentiment prevailed. Cheers to investors who shut out the negativity in both these periods and stayed focused on the positive trends in the data rather than on the anxiety-filled headlines!

Strong Fundamentals Power Return to Normal

We’re pleased that several other key calls we made for 2024 played out nicely as well … growth stocks handsomely outperformed value stocks, large-cap U.S. equities bested small caps and domestic stocks far outpaced international. Our “return to normal” theme turned out to be spot on as economic and earnings growth, levels of inflation and interest rates and the rate of improvement in labor productivity all normalized in constructive fashion.

The bottom line is that U.S. equities have been on a tear these past two years, with the S&P 500 rising more than 2,000 points, resulting in investment returns in excess of 60% over that time period.3 Wow! The primary catalyst for this is quite simple: the strong trend in the fundamentals. The surge in inflation caused by the pandemic peaked in June of 2022, and it has been improving ever since. The other fundamental metrics cited above—such as growth in the economy and earnings—have been far more robust than expected by the more bearish inclined and solid throughout. In other words, this bull run has been grounded in real stuff. It’s not fake or cosmetic.

Our Forecast: Blue Skies Ahead

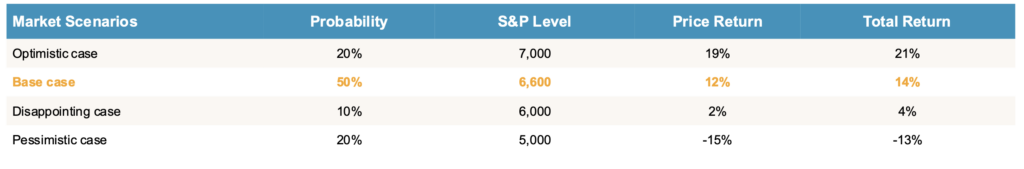

So, the question at this point is can the stock market advance continue? The short answer is that we still see blue skies ahead in the new year. To wit, we call for an S&P price level of 6,600 by year-end 2025 in our base case and envision 7,000 in an optimistic scenario. Of course, we see risk factors that might arise that could result in far less profitable outcomes, but such pessimistic results are far lower in probability, in our minds. We will cover the table below and our Crystal Ball Outlook in detail in our January 16 call with our clients.

2025 Base Case

Expected Environment

- Real GDP growth of 2.0% to 2.5%

- Fed Funds neutral rate of 3.75%

- 10-year Treasury yield trades in a range of 3.5% to 5.0% with the average around 4.5%

- S&P 500 earnings growth of 10-12% in 2025 and 12-15% in 2026

Optimistic Case: Based on P/E of 22.6x on 2026 consensus earnings estimate of $310.

Base Case: Based on P/E of 21.3x on a 2026 consensus earnings estimate of $310.

Disappointing Case: Based on P/E of 20x on a slightly lower than 2026 consensus earnings estimate of $300.

Pessimistic Case: Based on a 18x P/E on a disappointing 2026 earnings estimate of $280, down from current consensus estimate of $310. Tariffs reignite inflation and expected growth stalls.

IMPORTANT: The target return expectations regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results.

These price target expectations are for the next 12 months through December 2025. For all the scenarios outlined above, the price return is determined using a starting level of 5900, the closing price for the S&P 500 on December 30th, 2024, and the total return is incorporating the impact of dividends; we are using a flat 2% expected dividend, and the actual dividend yield will vary. Consensus earnings projections based on information obtained from FactSet. The environment set forth above is an estimate based upon research and formulation of estimates. There is no guarantee that any claims made will come to pass. Individuals cannot invest directly in an index. Index returns do not include the impact of trading costs or advisory and other fees. Scenarios are subject to ch ange at the firm’s discretion with no notice to you.

Expect Some CAT in 2025

Despite the positive gains we expect in 2025, we anticipate quite a bit of clear air turbulence (CAT) throughout the year that will be unsettling to investors. In the world of meteorology, CAT is defined as unpredictable and invisible air movement that occurs in cloudless skies, usually at high altitude. CAT is invisible and can’t be detected by sensors or seen by the naked eye. This is unlike dark cloud-filled storms and dangerous formations in weather patterns that can be detected by radar and avoided by pilots.

CAT often occurs without warning. Fortunately, CAT has not caused any crashes, but it does about $200 million in damage to various aircraft annually and is no fun to experience if you are a passenger.4 In terms of human impact, passengers arrive at their final destination but are a bit shaken by the ride.

Market Upside Dependent on Earnings Growth

I’m sure by now you can see where I’m going with this analogy. Continued healthy fundamentals (blue skies) should get us to our 6,600 S&P 500 price target but not without moments of investor/passenger angst. Of concern, valuation appears pretty full to us. With the S&P 500 trading at 22 times earnings, upside is dependent on earnings growth developing as planned and therefore more limited this year, in our view.5 If there are any meaningful curveballs on the policy front or if upcoming economic or earnings releases are less than perfect (i.e., CAT-type events), this could cause swift pullbacks and corrections on the still-ultimate path to double-digit gains in 2025. The ride simply might not be quite so smooth this year.

Other key points we will emphasize in our January 16 Crystal Ball Outlook presentation include:

- We’re Taking Our Rose-Colored Glasses Off—We’re Middle of the Pack Forecasters in 2025. The poor reactions to the Federal Reserve (Fed) rate-cut decision and associated press conference in mid-December (a decision and message we ironically applaud and find wise) and to the late-December threats of government shutdown in Washington affirm our vocal public message of late … yes, this strong advance in the market the past two years has been warranted/deserved, but the current high altitude in valuation leaves investors vulnerable to that less-than-PERFECT news flow like these two events. Random news flow events like this can drive temporary, yet sharp, pullbacks. Get ready for more such volatility throughout 2025.

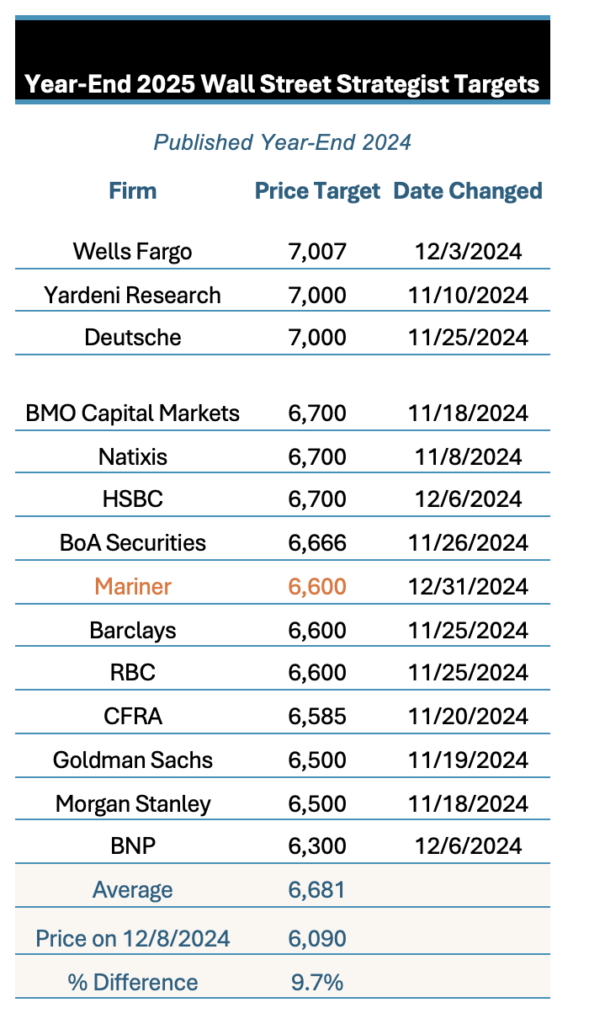

Hence our theme for the equity markets in 2025 is “A year of transitions and risk awareness.” This is far more cautious and moderate than our ultra-contrarian and bullish themes in 2023 of “2023 is likely to be the opposite of 2022” and in 2024 of “Return to Normal.” Rather than being top of the heap of strategists’ S&P price targets, as we were in those years, our base case price target of 6,600 is middle of the pack in 2025, and we recognize risk scenarios of lower probability that could be less fruitful.

Interestingly, as many of the investment strategists on Wall Street who have been quite bearish these last two years are putting their rose-colored glasses on, we are starting to take ours off.

Data sourced from Strategas

- Don’t Get Too Cute. Another difference between our message and what we see out there in strategist land is that quite a few experts feel that equities will show strong returns early in 2025 and then weaken in the second half as the bloom gradually comes off the rose and giddiness about potential tax cuts and deregulation shifts to worries and the inflationary impacts of tariffs, ballooning federal spending/debt and draconian deportation proposals.

Perhaps that is right. If forced to get cute on exact timing regarding performance results in the first half versus the second half, we can envision the flip of this: a rough first six months in 2025 (and therefore a better second half) and significant pullback(s) earlier in the year as folks defer capital gains realization into January and decide to panic a bit at that point, whether the freak-out moments are associated with further news flow about fiscal and monetary policy debates and rates or simply in connection with esoteric economic releases and earnings releases that aren’t absolutely perfect in nature.

At the end of the day, it really doesn’t pay to get too cute here speculating about the timing of gains in an intra-year period. The bottom line is that when all the dust settles on Dec. 31, 2025, we are looking for low double-digit returns for the full calendar year grounded in the solid fundamental data. - Hold Your Ground message to our clients is retained. Regardless of timing, IF the past two years of stellar returns have taken your normal 60% stocks/40% fixed income, cash and alternatives portfolio allocation to well above the normal 60% stock allocation target, please take advantage of those robust stock gains and cut back to normal.

We would anticipate using sell-offs in 2025 as buying opportunities, depending on trend in the fundamentals and true cause of the sell-off. Pruning to normal in advance will give one the courage to buy on weak price behavior when the underlying economic and earnings data is positive, yet the crowd is crabby and scared. - Technically Speaking. We would be remiss if we didn’t mention the technical price trends in late November and December. The technicals seem to be signaling the market is tired and wants to pause and correct here.

The advance-decline data has been quite poor this month, and the number of stocks hitting new 20-day lows has spiked. Leadership has narrowed again in the closing month. Unlike the historic Santa Claus rally in 2023, the market stalled as this year came to a close. To be clear, this does NOT signal the beginning of a bear market, as the fundamentals remain solid. But it does seem to be telling us the S&P needs a well-deserved break and wants to come up for some air after working very hard for quite a while. We will continue to listen! - Wildcard Risks We Will Monitor Closely. The key wildcard risks we will be watching closely in 2025 are the trend in interest rates, inflation, labor productivity and profit margins. If trends in these metrics are not as constructive as we expect in our base case, it could inspire a recession that no one anticipates at present and discredit our base case outlook.

Wrap-Up

We expect to land safely at our planned destination in 2025, but please fasten your seat belts and steel up for some CAT during the journey. We’ll provide more details on January 16!

Key Takeaways

- The market outdid the robust gains we anticipated in 2024, with the S&P 500 delivering a 25.0% return for the year.

- Our “return to normal” theme played out in 2024 as economic and earnings growth, inflation, interest rates and labor productivity all normalized.

- Our theme for the equity markets in 2025 is “A year of transitions and risk awareness.” Healthy fundamentals should support our 6,600 S&P 500 price target, but any meaningful curveballs could cause swift pullbacks and corrections.

- While the timing of any significant pullback is speculative at best, we are looking for low double-digit index returns for 2025.

- The key wildcard risks we will be watching closely in 2025 are the trend in interest rates, inflation, labor productivity and profit margins.

Sources:

1-3FactSet

4American Geophysical Union

5FactSet

This commentary is provided for informational and educational purposes only. As such, the information contained herein is not intended and should not be construed as individualized advice or recommendation of any kind.

The opinions, forecasts, and other forward-looking statements expressed herein are not guarantees of any future performance and actual results or developments may differ materially from those projected. The information provided herein is believed to be reliable, but we do not guarantee accuracy, timeliness, or completeness. It is provided “as is” without any express or implied warranties.

The S&P 500 is a capitalization-weighted index designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is unmanaged and cannot be directly invested in.

Equity securities are subject to price fluctuation and investments made in small and mid-cap companies generally involve a higher degree of risk and volatility than investments in large-cap companies. International securities are generally subject to increased risks, including currency fluctuations and social, economic, and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

There is no assurance that any investment, plan, or strategy will be successful. Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results, and nothing herein should be interpreted as an indication of future performance. Please consult your financial professional before making any investment or financial decisions.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.