Sequence of Returns Risk: The $1,000,000+ Timing Risk in Retirement

The timing of when you begin to draw income from retirement accounts, not necessarily average returns, can be worth millions in retirement and the difference between having enough or running out of money.

If you start to draw income during a down market, you run the chance of running out of money, but if you’re more fortunate and start retirement account withdrawals during an up market, it could mean you end up with a few million more and have what you need.

With inflation at a 40-year high, it is crucial for investors to understand this hidden risk, and how to manage it.

Sequence of returns risk is the risk around timing, not necessarily the average. When do those good and bad years occur? This is incredibly impactful when you look at how much income you get to take in retirement as well as how much you get to leave behind.

This isn’t something you just get to retirement and flip a switch to plan for. There are ways to substantially decrease this risk leading up to retirement, and we’re here to help.

Typically, the best way to manage sequence risk is to deploy a variety of asset classes, not just stocks and bonds, but a collection of different asset classes. This is where retail investors are somewhat limited, and the correct combination depends personally on your situation, so click the link below to schedule a complimentary consultation with one of our advisors and learn more about how our comprehensive service can help you.

Transcript

Life is not linear. We know that there are good times and there are bad times, and the markets are no exception to this. There are good times in the market and there are bad times in the market. We know that average return, well, that’s going to affect how much money you have in your portfolio, performance will affect that. But what very few people understand is how the timing of returns, that is, when those good years occur and when those bad years occur, well, that can be worth millions in retirement—it can drastically impact how much you get to enjoy. So with inflation at a 40-year high and markets being quite volatile, we thought this would be a helpful video for you to understand this hidden risk so you can learn how to manage it. My name’s Michael MacKelvie, and I’m a certified financial planner with Mariner. And at any point in time, if you feel like you’d benefit from having a guide, you can schedule a complimentary consultation with one of our advisors using our scheduling tool.

Let’s dive into sequence risk now. So, this timing risk that we’re referring to today is called sequence of returns risk. And again, it doesn’t have to do necessarily with the average returns but rather the timing of returns.

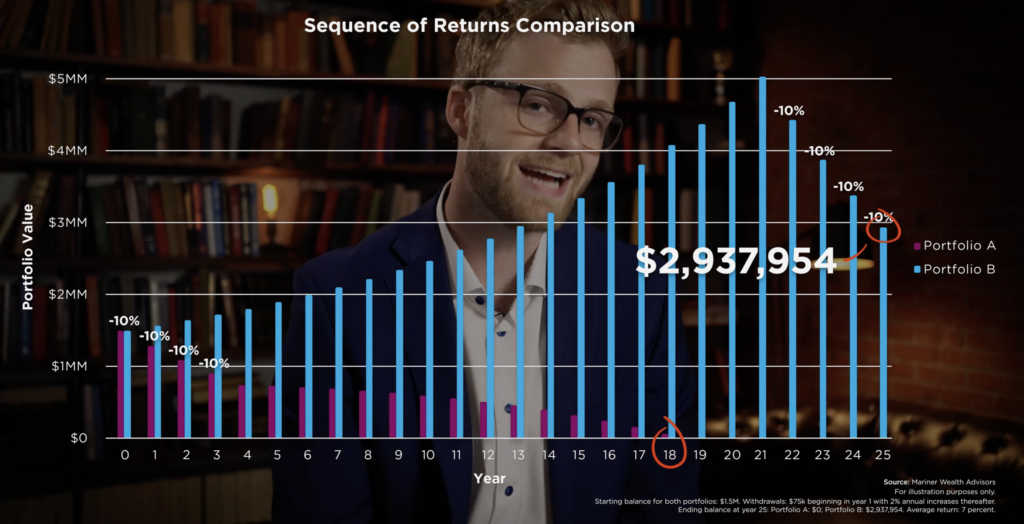

And I think the best way to illustrate this is just by looking at an example. I mentioned this can be worth millions in retirement, so let’s look at a million-dollar example for two different clients, both who have the same average return of 7% and 7%. So, all we’re going to do in this example is just flip the order of operations. So, client A is going to have four-straight negative 10% years in the beginning of this example, while client B is going to have those four negative years at the tail end of this illustration.

Source: Mariner Wealth Advisors

For illustration purposes only. Starting balance for both portfolios: $1.5M. Withdrawals: $75k beginning in year 1 with 2% annual increases thereafter. Ending balance at year 25: Portfolio A: $0; Portfolio B: $2,937,954. Average return: 7 percent.

And what we can see is client A, which is the purple graph, runs out of money 18 years into this example, while client B has roughly $3 million left in their account. That is a massive difference. Same average return, just the timing of returns making roughly a $3 million difference. So to understand this, let’s look a little bit deeper at the math. So let’s say you have a million dollars and you lose 25%. Now you have $750,000. You would need a 33% rate of return to get back to that million-dollar water line.

So again, when does negative 25 plus 33 ever equal zero? It doesn’t, right? But intuitively the response is, “Well, if I lost 25%, I just need 25% to get back to where I was at.” That’s just not the case here.

And the math gets even worse when you factor in withdrawals. So let’s assume we had the same 25% drop, but maybe this person is in retirement and they needed to take income from the portfolio and maybe their need was $50,000 each year. So let’s say we lost 25% over three years, but they also took $50,000 each of those three years. Now, we’re at $600,000. That’s 40% below that water line we originally began at, at a million dollars. We would need a 67% rate of return, not 40%, but 67% rate of return, to get back to that million-dollar number.

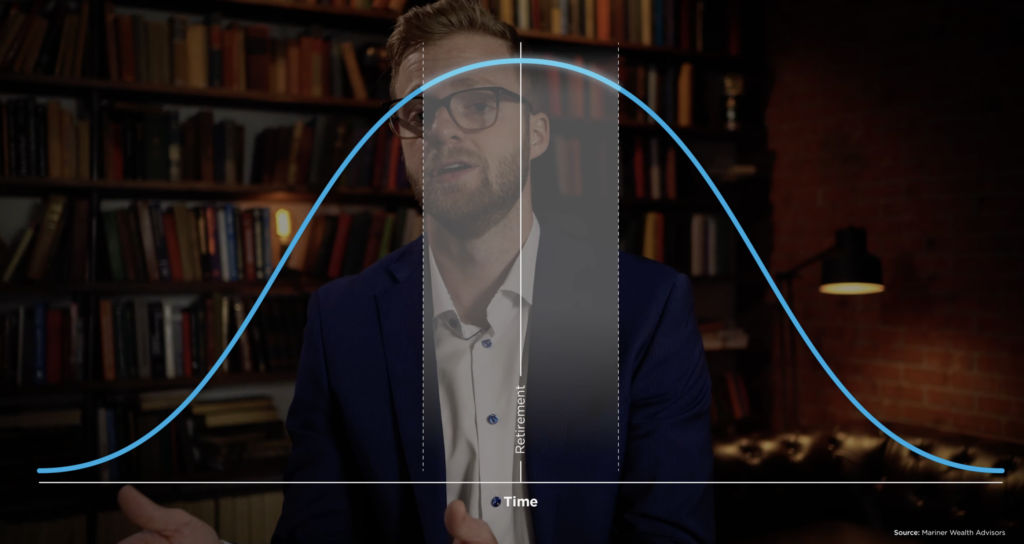

That hurts. Now of course, this isn’t something you just get to retirement, flip a switch and say, “Okay, hey, now I’m ready to manage sequence of returns risk.” There are ways to substantially decrease this risk leading up to retirement. It’s really present any time you’re contributing to an account or taking income from an account. But it’s most impactful in the years right before retirement and right after retirement, the timing is.

Source: Mariner Wealth Advisors

So typically the best way to manage sequence of returns risk is to deploy a number of different asset classes. So not just stocks, not just bonds, not just a few different stocks or a few different bonds, but a collection of assets. And I know retail investors are somewhat limited there. So if you feel like you’d benefit from having a guide, you can use the scheduling tool to schedule a complimentary consultation with one of our advisors here at Mariner. You’ll be able to pick a time that works for you for an introductory conversation. As always, hope you enjoyed this video and take care.

These videos are limited to the dissemination of general information and are not intended to be legal or investment advice. Nothing herein should be relied upon as such. The views expressed are for informational purposes only and do not take into account any individual personal, financial, or tax considerations. There is no guarantee that any claims made will come to pass.

The hypothetical examples are for illustration purposes only and are not intended to be representative of actual results or any specific investment, which will fluctuate in value. The determinations made by these examples are not guarantees or projections, and no taxes or fees/expenses are included in the calculations which would reduce the figures shown. Please keep in mind that it is possible to lose money by investing and actual results will vary.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.