Tax Planning During Market Corrections

Economic downturns and market corrections can provide opportunities for investors. Though it may be painful to watch your account values decline, it is important to maintain your long-term strategy and be proactive in looking for silver linings within the dark clouds of the current economic environment. This is particularly true regarding Roth IRA conversions.

How Roth IRAs Work

Traditional IRAs, 401(k)s and other retirement savings accounts are funded with pretax dollars— meaning that contributions are excluded from your taxable income in the year they’re made. Contributions and earnings are taxed when distributions are taken in retirement.

Roth IRA contributions, on the other hand, don’t lower your taxable income. Contributions can be withdrawn tax free, and earnings can be withdrawn tax free after at least five years since you first contributed to the account.

Roth IRAs are attractive to investors who believe that their tax rate could be higher in the future. In addition, they’re also appealing when account values are down because the amount being converted—and thus subject to tax—is lower.

Be Ready for a Tax Bill

Roth conversions generate a tax liability that is due for the tax year in which the transaction occurs. Depending on the amount of assets being converted, the levy may be substantial and may even push you into a higher tax bracket.

Calculating your tax bill can be tricky, particularly if you own other retirement accounts that are funded with pretax dollars, so it’s important to seek advice from your wealth team.

Before completing a conversion, make sure you have adequate funds to pay those taxes and resist the temptation to use a portion of the funds you’re converting for that purpose. Doing so will leave you with less to potentially grow tax free in the Roth and, if you’re under 59½, the amount withdrawn for taxes will be subject to a 10% early-withdrawal penalty. Because there is no limit to the number of Roth conversions an individual can do, many people stagger the conversion process across multiple years to manage the tax impact.

Opportunistic Tax Planning

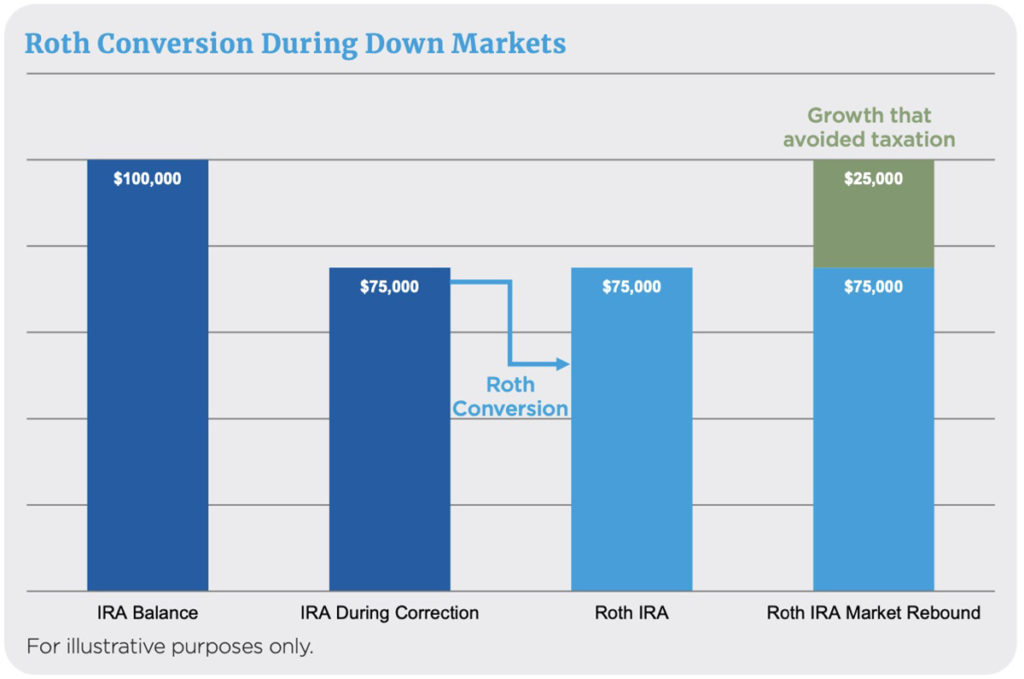

Imagine a scenario where, at the beginning of 2022, you had $100,000 in a traditional IRA. If you had made a full Roth conversion in January, you would have added $100,000 in taxable income to your tax return. If the balance of your IRA then dropped to $75,000 during the current market correction and you executed a Roth conversion on the lower balance, you would have to pay income taxes on $25,000 less than if you had converted at the beginning of the year.

Meet With Your Wealth Team

Now may be a good time to consider converting a portion of your traditional IRA to a Roth IRA. Talk to your wealth advisor about whether a Roth IRA conversion is right for you.

Keep Calm During Market Dips. Markets have their ups and downs, but it can sting when you see your portfolio balance drop. Here are 3 tips to help keep your plan in check.

Roth IRA Conversions are complex and treatment depends on the type of IRA that is being converted to a Roth IRA. The views expressed regarding Roth Conversions are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. It is not intended to be a solicitation to buy or sell or engage in a particular investment strategy. Before initiating a Roth IRA Conversion, please consult with a financial or tax professional and ensure you consider all your available options, including applicable taxes, fees and features.

If you convert a Traditional IRA to a Roth IRA, the amount of the conversion will be treated as a distribution for income tax purposes and is includible in your gross income (excluding any nondeductible contributions). Although the conversion amount generally is included in income, the 10% early distribution penalty tax will not apply to these conversions, regardless of whether you qualify for any exceptions to the 10% early distribution penalty tax. If you are required to take a required minimum distribution (RMD) for the year, you must remove your RMD before converting to a Roth IRA.

A distribution from a Roth IRA is tax free and penalty free, provided the five-year aging requirement has been satisfied and one of the following conditions is met: age 591⁄2, disability, qualified first-time home purchase or death.

This article is limited to the dissemination of general information pertaining to Mariner Wealth Advisors’ investment advisory services and general economic market conditions. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on information and sources of information deemed to be reliable, but Mariner Wealth Advisors does not warrant the accuracy of the information that this opinion and forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.