Three Yards and a Cloud of Dust: Alternative Economic Scenarios

Read time: 8 minutes

Last month we published our “core” economic call for 2025 entitled “Three Yards and a Cloud of Dust,” reminiscent of the days of coach Woody Hayes and Ohio State football. Coach Hayes was a fan of running the football to gain yardage instead of passing, a lower-risk, lower-volatility outcome.

Coach Hayes was truly “old school” in his view, which was that passing the ball can create three possible outcomes—with two of those outcomes being bad (incompletion or interception). He believed in running the ball, grinding down the field three yards at a time, creating a cloud of dust and winning football games. While at Ohio State, Hayes won 76% of the games he coached. Coach Hayes knew what he was doing.

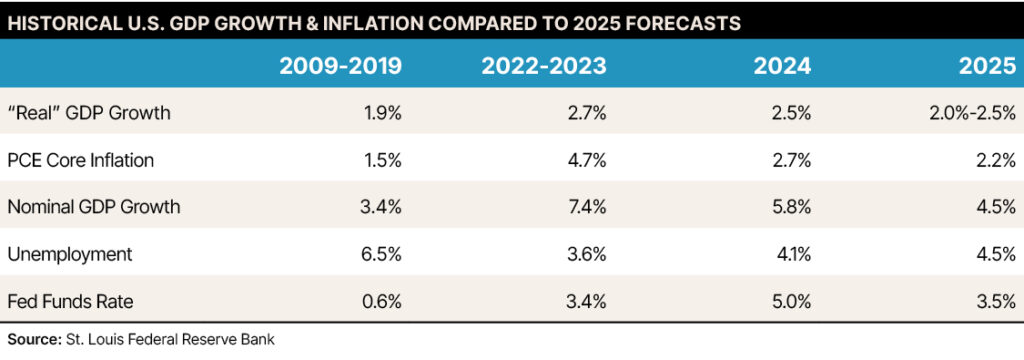

I see the U.S.’s economic performance next year being like “Three Yards and a Cloud of Dust,” a lower-risk, lower-volatility environment. Below are our target growth and inflation forecasts for 2025 as compared to historical data.

We expect gross domestic product (GDP) growth to decelerate slightly in 2025 and for inflation to decline. It is important to understand that GDP growth of 2% is lower than average, as noted below.

We have stated our confidence level regarding the core outlook is about 60%. That leaves 40%, or almost half, for which a different outcome may occur that the Three Yards view doesn’t capture. What might be the alternative outcome? Two broad possibilities come to mind.

Economic Boom

From a historical standpoint, the U.S. economy has grown much more rapidly than 2%. Since 1950, the U.S. economy has grown by an average of 3.2%1, as noted above. For some time, demographics, government spending increases and consumption preferences have led to GDP growth that has recently been systemically slower. Note the data outlined above: Over the last 38 years, the economy has grown by an average of 2.6% as compared to the 3.8% growth rate witnessed over the 1950 through 1985 time frame.2 But at the same time, the volatility in GDP growth subsided rather dramatically, as witnessed by the noted standard deviation data. One possible alternative to our Three Yards theme is the economy grows more rapidly than our expectation, entering a “melt-up” or “boom” phase.

Dr. Robert Dieli, a friend and great economist, produces the “No Spin Forecast.” Bob suggests that as they mature, many business cycles eventually enter a “boom” phase. During this time, excesses are created as the economy grows rapidly, creating imbalances. We currently don’t see many economic imbalances, save government debt creation, which over the long term is probably not sustainable.

But as the economy currently seems “balanced,” we are starting to see “animal spirits” rising among businesses, investors and consumers. The stock market is up more than 20% in value each of the past two years.3 Some suggest giddiness has entered the financial markets.

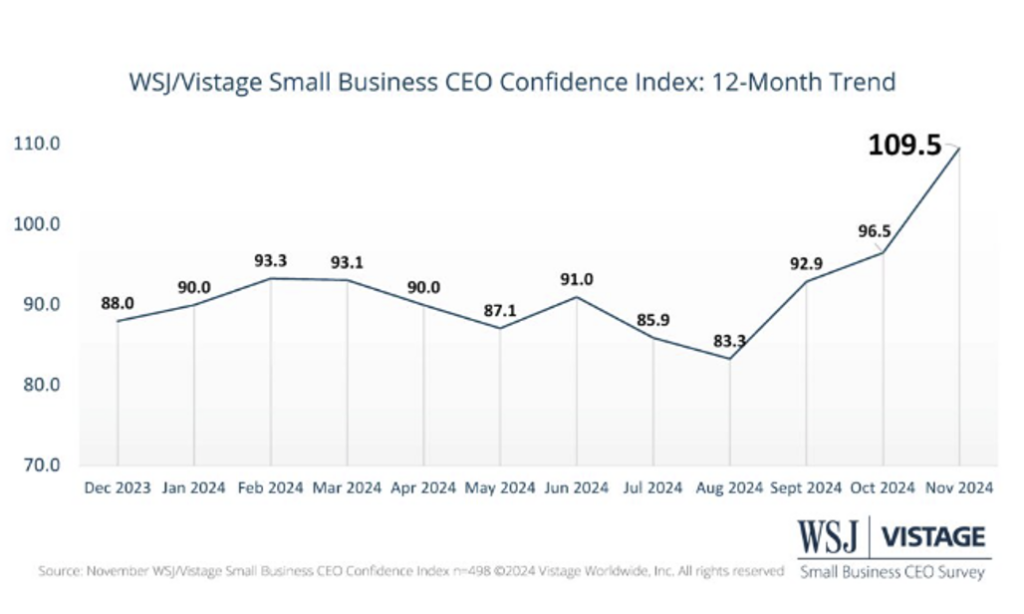

In addition, small-business sentiment has recently improved at a rapid clip. This is an important development, as small businesses (businesses that employ fewer than 500 employees) historically have created 63%4 of new jobs.

Over the last month, we have seen a surge in positive small-business confidence, seemingly driven by the outcome of the recent election. See the chart above from the folks at WSJ/Vistage.

As noted, small-business confidence is up significantly since the low reached in August of this year. The 13-point jump in confidence that occurred in November is the largest single-month increase in small-business confidence over the last four years.5 According to the results of the recent poll, small businesses:

- Are hoping for lower taxes for reinvestment, employee benefits and business growth.

- Are optimistic about targeted, predictable trade policies over broad, indiscriminate tariffs.

- Are hopeful that the government regulatory environment will ease, lowering compliance costs in a number of areas.

The poll results show that 64% of businesses plan on adding to headcount over the next 12 months, the highest hiring plan result in nearly two years.6 While these plans and viewpoints may moderate as reality as compared to hopes comes into focus, it is notable that business sentiment has increased since the election, which suggests we may see an uptick of activity in the small-business segment.

Our core case is calling for unemployment to rise in 2025 to 4.5% from 4.1%. If small businesses hire more aggressively, the unemployment rate may decline to the 3%+ range. This may raise the issue of inflation accelerating, which would alter the Federal Reserve’s (Fed’s) plans of lowering interest rates.

So, while a “boom” phase sounds pleasant, and something to enjoy, real GDP growth rates may indeed rise to the 3%+ level and rising inflation pressures may come back into the picture. While it is early, we suggest that the “economic boom” outlook carries a 25% probability of coming to pass.

Growth and Confidence Disruptions

The other reasonable outlook expectation, representing a 15% probability, is one that isn’t particularly pleasant, with growth slowing to a point where an outright contraction—or recession—may indeed be in the cards. We currently don’t see, or expect to see, serious economic imbalances occur, such as a monetary liquidity squeeze to unfold, but we see a number of noneconomic risks present in today’s world, which may prove to be disruptive.

- How will the Trump policy changes unfold? We see the following potentially happening as 2025 unfolds, possibly creating a mixed bag of pressures on economic activity.

- Closing the border and removing undocumented immigrants – This scenario would place pressure on the labor market, potentially irritating the jobs market, raising wage growth and aggravating inflationary pressures.

- How will the Trump administration change our global leadership position, both militarily and diplomatically?

- China is not going to stand still –With increased tariffs on the horizon, how will China react? This scenario could weigh on supply channels, increasing inflationary pressures and disrupting growth rates in certain industries.

- Competition for capital: How will bond markets react to rising needs for financing?

This list of potential irritants to economic balance isn’t complete. But it is possible that these, or other, variables may surface and increase economic imbalance, leading to more volatility in GDP growth and/or inflation pressures.

Worker Productivity

Lastly, we need to comment on worker productivity growth rates. As the chart from Yardeni Research shows, since 2022 worker productivity growth rates bounced back to 4% and are now around 2% on a year-over-year basis as compared to an average growth rate of 1.3% since 1990.7

The rebound in worker productivity growth is providing positive impact on inflation pressure, allowing businesses to pay workers higher wages without the need to raise prices.

Worker productivity growth rates are the “mother’s milk” of economic wealth creation and among the most important economic trends. We need to monitor productivity growth rates closely.

The probability of an adverse economic environment unfolding over the next year or so should remain muted as long as productivity growth remains positive. Worker productivity is driven by innovation and capital spending. We are looking for the eventual productivity enhancements radiating from the buildout of the AI industry.

We stand by our Three Yards and a Cloud of Dust theme for 2025, an environment where overall economic activity remains positive with both inflation and short-term interest rates continuing to decline. But as with any economic outlook, the possibility of surprises remains.

Sources:

1,2St. Louis Federal Reserve Bank

3Thomson Reuters

4-6WSJ/Vistage Small Business CEO Study

7St. Louis Federal Reserve Bank

This commentary is provided for informational and educational purposes only. As such, the information contained herein is not intended and should not be construed as individualized advice or recommendation of any kind.

The opinions and forward-looking statements expressed herein are not guarantees of any future performance and actual results or developments may differ materially from those projected. The information provided herein is believed to be reliable, but we do not guarantee accuracy, timeliness, or completeness. It is provided “as is” without any express or implied warranties.

There is no assurance that any investment, plan, or strategy will be successful. Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results, and nothing herein should be interpreted as an indication of future performance. Please consult your financial professional before making any investment or financial decisions.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.