Trusts Offering a Silver Lining in a High Interest Rate Climate

Given the current high interest rate environment, you may be wondering whether there are strategies you can employ to create a more efficient estate plan. Two “silver lining” strategies to consider are a qualified personal residence trust (QPRT) and a charitable remainder trust (CRT).

When Does a QPRT Make Sense?

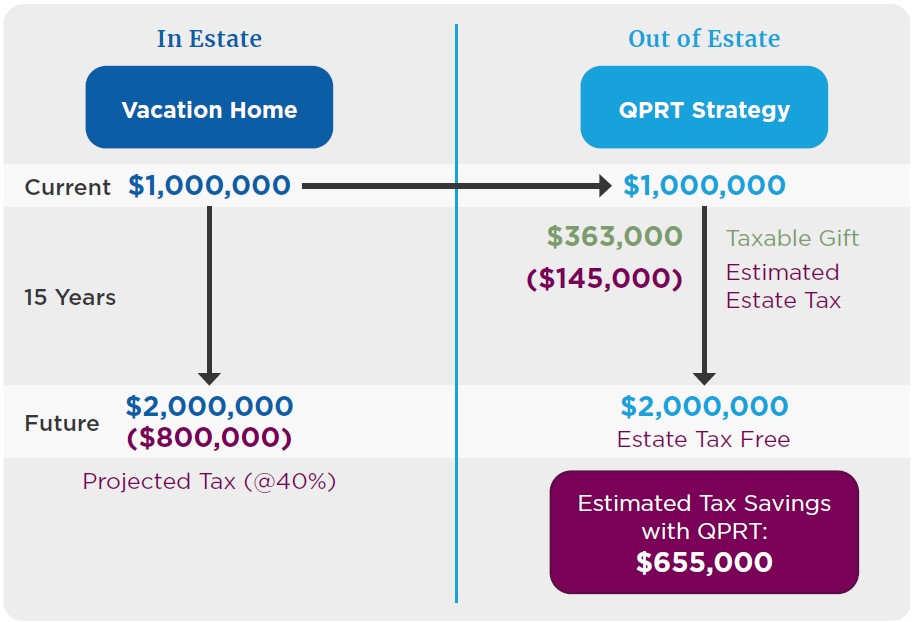

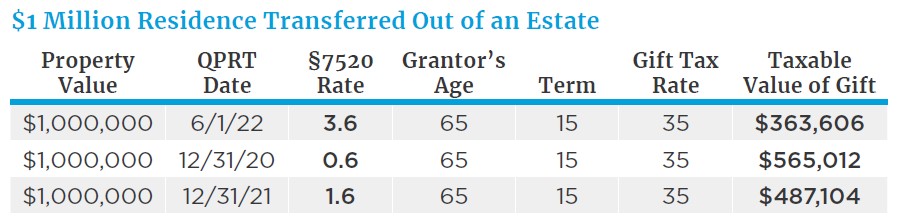

If you have a second home or vacation property that’s been in your family for generations, and you would like to transfer that home to your children or grandchildren, then a QPRT offers a way to do that in a tax- efficient manner. See the illustrations below that show a $1 million residence projected to be worth more than $2 million that has been transferred out of an individual’s estate as a “taxable” gift for $363,000 using a QPRT (versus giving it to children or grandchildren as an outright gift for $1 million). If this same gift had been made in December of 2020 (as the table below shows), it would have generated a taxable gift of $565,000 as opposed to the lower gift of $363,606. Note the estimated tax savings of $655,000 as a result of using the QPRT to transfer your residence to a beneficiary.

Charts are hypothetical, for illustrative purposes only.

CRTs Offer Multiple Tax Benefits

How CRTs Work

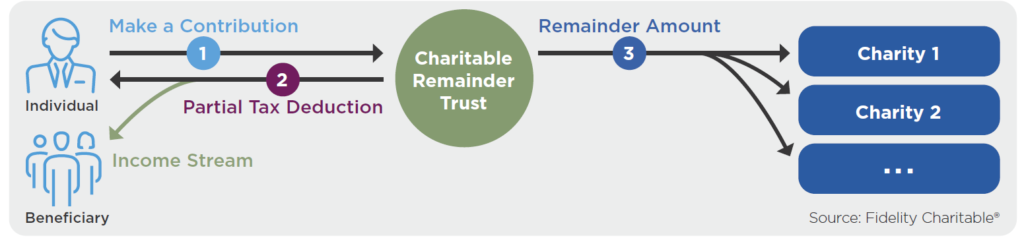

A CRT is an alternative to giving assets directly to a charity. A CRT is a “split interest” giving vehicle that allows you to create and fund the trust and be eligible for an income tax deduction based on the CRT’s assets that will pass to charitable beneficiaries. You can name yourself or someone else to receive an income stream for a term of years (no more than 20) or for the life of one or more individuals, and then name one or more charities to receive the remainder of the donated assets when the trust terminates.

CRTs are a great way to diversify a concentrated, low-basis asset, such as a concentrated block of stock that has appreciated substantially since you bought it or real estate that has significantly appreciated. A CRT allows you to avoid the unrealized capital gains while keeping an income stream for life or a period of years. When you create a CRT, it generates a charitable income tax deduction for you on your Form 1040. Because of the higher interest rates, charitable income tax deductions now are also higher.

Consult With Your Wealth Team

At Mariner, your advisor can consult with our in-house estate planning and trust services team to help design trusts for you such as the QPRT and CRT to ensure your wealth plan is as tax-efficient as possible.

Some services listed in this piece are provided by affiliates of MWA and are subject to additional fees. Additional fees may also apply for tax planning and preparation services.

This commentary is limited to the dissemination of general information pertaining to Mariner Wealth Advisors’ investment advisory services and general economic market conditions. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on information and sources of information deemed to be reliable, but Mariner Wealth Advisors does not warrant the accuracy of the information that this opinion and forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.