With High College Expenses, Should Students Consider Work Options Instead?

How does the current employment climate, the rising cost of education and student loan debt change how we think about your children and grandchildren going off to college? Students may decide to choose an alternative path, such as being an entrepreneur or heading to some of the blockbuster firms like Google that don’t require a college degree for work opportunities.

College? Consider a 529 Plan

If you have grandchildren or children who do want to go to college, and you want to financially support them, it’s good to plan ahead and open education savings accounts like 529 Plans sooner than later to receive tax benefits and to allow the contributions to grow tax free until they are used for eligible educational expenses.

A Degree Doesn’t Define Success

During the pandemic, students primarily learned virtually. Before that and today, the high cost of learning may have families wondering whether college is worth the cost. The emphasis on a flexible work environment, which was largely accelerated with the pandemic’s work-from-home structure, has also contributed to changing workforce dynamics, adding to the many factors at play.

The rise of what many dub “the sidepreneur” has become more prevalent. Many Millennials have turned to serial entrepreneurship, and they continue to adapt well to the remote environment as we have come out of the peak of the pandemic. Although academic qualifications certainly will continue to play a role, many major companies – including Google, Hilton, Apple, IBM, Bank of America, Tesla, and Netflix – no longer require college degrees.

The bottom line is that a college education is not a necessity or predictor of financial success as it once was several decades ago. A new era may be upon us, pointing toward the idea that college degrees may not be as important as they once were.

A Closer Look at Student Debt

Among the class of 2019, 69% of college students took out student loans, and they graduated with an average debt of $29,900, including both private and federal debt. And 14% of their parents took out an average of $37,200 in federal parent plus loans. Looking at it more broadly Americans owe over $1.71 trillion in student loan debt, spread out among about 44.7 million borrowers. That’s about $739 billion more than the total U.S. credit card debt.1

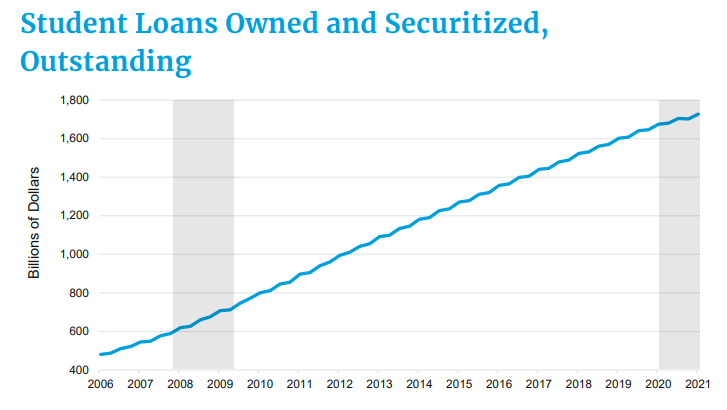

In looking at the chart below, in the first quarter of 2021 alone, there was $1.7 billion in outstanding student loans. Keep in mind too that President Biden has delayed payment on student loans plus interest until September 2021 as a result of the pandemic. You might also consider refinancing or even loan consolidation. But perhaps not for all, since refinancing/consolidating to a private lender will remove temporary federal benefits related to pandemic that could be associated with the student loans.

U.S. recessions are shaded; the most recent end date is undecided. Source: Board of Governors of the Federal Reserve (US)

Student Loans Linger for Young Professionals

Student loan debt is an obvious stressor in many young professionals’ lives. Many are concerned about making ends meet while still managing to pay off their student loans. These loans also affect their ability to save for long-term goals such as retirement.

Young professionals who have highly skilled jobs such as doctors, lawyers, engineers, architects, etc. do not typically regret the costs of undergraduate or graduate school since these professions are associated with higher incomes.

Use Educational Savings Accounts Strategically

If attending a college or university is in your child or grandchild’s future, it’s important to consider savings and investment opportunities now. The earlier you invest in your child’s future college education, the better since the investment’s future growth largely depends on compounding interest, which typically takes years to grow.

Partner With Us

At Mariner, we’ll work with you on a tax-advantaged strategy for funding college. We’re here to help you navigate your financial future and to create a comprehensive wealth plan that includes saving for college should your child or grandchild decide it’s worth it to pursue a college degree.2

For more on this topic, check out our podcast on how to keep your kids financially literate.

Sources:

1 “A Look at Shocking Student Loan Statistics for 2021”

2 “529 Savings Plans and Private School Tuition”

Investors should consider the investment objectives, risks, charges, and expenses associated with 529 plans before investing. More information about specific 529 plans is available in each issuer’s official statement, which should be read carefully before investing.

The availability of tax or other benefits may be conditioned on meeting certain requirements, such as residency, purpose for or timing of distributions, or other factors as applicable.

The information contained herein is not intended to be personal legal, investment or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such. The information contained herein is current as of 2021 and has been obtained from sources believed to be reliable, but Mariner Wealth Advisors does not warrant the accuracy of the information. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. There is no guarantee that any claims made will come to pass. Consult a financial, tax or legal professional for specific information related to your own situation.

The views expressed are for commentary purposes only and do not take into account any individual personal, financial, legal or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. The opinions are based on information and sources of information deemed to be reliable, but Mariner Wealth Advisors does not warrant the accuracy of the information. Additional fees may apply for tax planning and preparation services.

Mariner is the marketing name for the financial services businesses of Mariner Wealth Advisors, LLC and its subsidiaries. Investment advisory services are provided through the brands Mariner Wealth, Mariner Independent, Mariner Institutional, Mariner Ultra, and Mariner Workplace, each of which is a business name of the registered investment advisory entities of Mariner. For additional information about each of the registered investment advisory entities of Mariner, including fees and services, please contact Mariner or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website. Registration of an investment adviser does not imply a certain level of skill or training.